We're in the business of knowing Amazon. With the world’s most comprehensive digital retail performance tools and intelligence at our disposal, understanding the past, present and future of ecommerce is one of our most important assets.

In the early days of the New Year, we can't help but look ahead. We must admit (whether it fills you with hope or with dread) that Amazon will be a big part of all of our lives in 2019. The question is: what does the retail and technology juggernaut have planned? What has Amazon been up to at the turn of the year and how will those plans come to fruition in 2019 and beyond?

Here at Edge, predicting Amazon's next moves is a big part of our job. But the complex and subtle forces applied by competing channels, supply chains, regulations and consumer interests – each of these factors subject to rapid and surprising changes – makes prediction a broad and long-term game. So to inform brand manufacturers and other stakeholders, we haven't limited ourselves to Amazon's short term goals. Instead, we've broken our predictions out by distance: what's a hand's breadth away, what's 10k feet away and what's 40k feet away.

The Short Term

1. Amazon's Panda

This time last year, there was a huge market for people willing to write reviews in exchange for coupons or other deals on products listed on Amazon. This was not a black market by any means – until 2016, Amazon had no policy against incentivized reviews – but it was still kept under the radar in an effort to hide review biases from shoppers. Then at the beginning of April 2018, Amazon finally cracked down and banned thousands of reviewers for breaking the company's review policy or using their account for 'commercial purposes.'

Then, just weeks before the holidays, the news broke that Amazon had fired numerous employees for leaking insider info to malicious sellers. This info was being used to manipulate Amazon's search algorithms in order to fraudulently gain a higher search ranking against competitive products. Other malicious practices include sellers flagging their competitors as counterfeit or trademark infringement in order to get their listings temporarily pulled from search results.

For most online shoppers, Amazon is even more popular than Google as a search engine – but, like Google, this means that Amazon's value to these shoppers is correlated to the quality of its search results. That's why this is the year that Amazon releases their version of The Google Panda Update, a major search filter launched by Google in 2011 which flagged and blocked low quality sites from appearing in search results. With the Panda update, Google cracked down on black hat SEO and other techniques used to game the search ranking algorithms.

Amazon is overdue for its own version of Panda. In 2019, we can expect Amazon to improve their search algorithms to be smarter about favoring high quality products and complete detail pages while filtering out keyword-spamming, plagiarism and untrustworthy reviews. This is bound to have some direct impacts on brand strategy which won't be immediately apparent until the updates take effect.

Brand implications: Monitor your performance carefully in order to identify any once-good practices that may become disfavored – such as long, keyword-heavy titles – and to adapt to the changes as quickly as possible. If you are looking for white hat SEO strategy, tactics, execution and performance monitoring for online retail, Edge can help.

2. The Year of 3P

Amazon was once controlled by first party vendors (1Ps), meaning brand manufacturers that sell inventory directly to Amazon, who then sells it to the customer. For shoppers, these items appear on the platform with the label "Ships from and sold by Amazon.com". But their share of Amazon's sales has been shrinking year after year as third party vendors (3Ps) increase their presence.

2018 was the first year that 3Ps, who use Amazon as a marketplace to sell directly to consumers, consistently controlled more than half of the platform's sales – and this fact has not been lost on Amazon. Currently, 1Ps have many advantages over 3Ps, including access to A+ content, premium advertising tools and the ability to merge 3P sellers onto their 'parent' 1P product pages. But the retail and tech giant has begun to roll out the red carpet for 3Ps by reducing fees and expanding some formerly 1P-only features such as Subscribe & Save and Prime eligibility. By adding this fuel to the already growing fire of 3P market share, we expect third parties to control as much as 70% of Amazon's unit sales by the end of 2019.

Beyond simply adapting to a clear shift in the market, this investment in 3Ps is also a way for Amazon to hedge its bets against the likes of Walmart and Target. According to our forecasts, the 3P market will account for 64% of global ecommerce sales added through 2022 and those merchants will favor the platforms that offer the best features and lowest fees. Amazon is not going to simply allow Walmart to maintain that competitive advantage.

Brand implication: Because the competitive advantage of being a first party is shrinking, some brands may consider selling as third parties. By using Amazon solely as a marketplace and fulfilling orders directly from the manufacturer's warehouse, brands could set their own prices and increase their profit margins.

3. Alexa Leaves the Shopping to You

One advantage that's not panning out for Amazon is that consumers are not using Alexa for shopping. Jeff Bezos said so himself when he stated that “most shopping will be facilitated by having a display” and now the practical user data has proven him right. So in 2019 we expect to a major innovation in the display segment of Echo that is more shoppable than the Show or any other display-based devices. A Virtual Reality component shouldn’t be ruled out.

On the consumer side of things, Echo uses are simple. The Echo Wall Clock, made available in December (just in time for the holidays) pares Alexa down to one of its most popular functions: a voice-activated timer. But this is just a scout for an advancing force of everyday products enhanced by Alexa. A year from now, Alexa will be to technology what cranberries are to juice – it will be in everything.

Brand implications: Identify which products would benefit from Alexa-compatibility and consider incorporating Amazon's voice technology into the next generation, especially (but not exclusively) for brands in electronics or appliances.

4. First Sweden, then the World

After a three year gap, Amazon began introducing new localized sites in 2017, starting with Singapore in July followed by Australia in November. In September 2018, they opened their latest localized site in Turkey. Up next is Sweden.

Rumors early last year predicted a Q2 2018 launch of Amazon Sweden. This clearly did not come to pass, but Amazon is currently on a hiring spree in Stockholm, so we can confidently predict that Amazon Sweden will be in operation before the end of the year – and probably a lot sooner.

Additionally, there will be many more launches in new markets within the next five year, with Southeast Asia likely to be a focus going forward.

Brand implications: Every time Amazon opens a new localized site, it opens up a whole new audience. International expansion could never be easier, so brands that have the resources to do so should seriously consider following the ecommerce giant into these new markets.

The Medium Term

5. Grocery Finally Hits

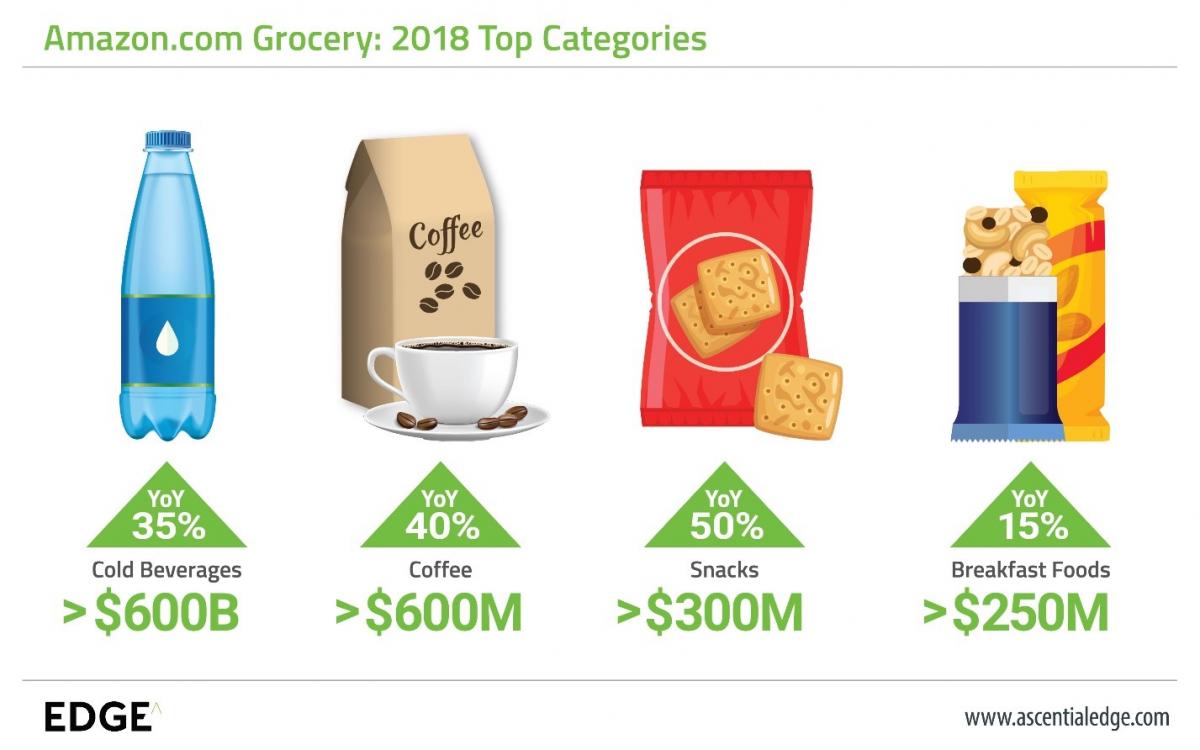

In 2018, grocery sales on Amazon.com grew by about 45% compared to 2017. That's nothing to scoff at, but it is a drop from the 2016-2017 growth rate of nearly 60% and Amazon is still a long way off from where they had hoped grocery sales would be by now.

Of the roughly $3 billion in sales on Amazon.com, nearly half fell under the coffee or cold beverages category and most other sales were for non-perishables like snacks and cereals. Amazon has spent years trying to expand grocery beyond these limited categories and get fresh food off the ground, but with little success. Programs like Prime Pantry and Amazon Fresh have failed to convince shoppers to turn to Amazon for their fruit, vegetables, meat and other perishables.

But Amazon has no intention of giving up on fresh food – they just need to change their strategy. We predict that Amazon is finally going to discontinue the sub-par Pantry service, or at least merge it into another program like Prime Now or Fresh, and go all in on brick and mortar grocery sales. Consumers still value their ability to see, touch and smell before buying, so why not give them what they want?

On the last day of 2018, the Wall Street Journal reported that Amazon plans to add more Whole Foods stores across the US including many in suburban areas, putting more customers within range of the retailer's two-hour grocery delivery service. Earlier in December, Reuters reported that Amazon was exploring the possibility of introducing the checkout-free Amazon Go stores into several top US airports. These moves underscore the ecommerce giant's understanding that brick and mortar retail is key to winning the grocery market, and Amazon is committed to doing so.

Brand implications: Fresh food is at the heart of shopping. When Amazon Grocery finally hits, it will mean consumers are spending even more time with Amazon's properties – both online and offline – and brands will need to do the same. Out of stocks are one of the biggest issues for grocery delivery, with substitutions often made with store brand or competitors, so brands will need hyper local monitoring capabilities to forecast inventory as well as to monitor regionalized pricing and promotions.

6. Doctor Bezos

Amazon is making a major bid on health care. In January 2018, Amazon, Berkshire Hathaway and JPMorgan Chase & Co. announced the formation of a health care company with the goal of providing affordable health insurance to their employees in the US. It's not such a stretch to think that it's only a matter of time before this health insurance is made available to the general public as well.

There's also the mid-2018 acquisition of PillPack, an online full-service pharmacy specializing in ongoing and chronic prescription medications. PillPack simplifies medications by sending customers a 14-day supply of prescriptions divided into daily packets. This acquisition, which follows the launch of the Basic Care over the counter medication brand produced by Perrigo exclusively for Amazon, solves one of the retailer's key barriers in this space – the challenge of acquiring pharmaceutical licenses to sell online in all 50 states. We predict that Amazon will soon integrate the PillPack pharmacy services with the main marketplace. When that happens, this new flow of medically-motivated consumers will pose an opportunity for Amazon to upsell other health care items, including its private label OTC medications but also medical equipment, supplements, and nutrition and wellness products.

Brand implications: Amazon growing into a major health care destination will seriously disrupt the drugstore sector, with potential to shift event more share from brick and mortar to online. Impulse categories will be particularly impacted as impulse behavior does not translate well online.

7. Acquisitions, Acquisitions, Acquisitions

The two previous predictions both used acquisitions as evidence – Whole Foods and PillPack respectively – but we also predict that there are a lot more where those came from. Amazon's aggressive acquisition strategy will continue through the next few years at least, with criteria varying based on region.

In the US, look for Amazon to go after more physical presence. The retailer will target gaps in its current coverage, such as regions and shopper segments untapped by Whole Foods. Amazon has already announced the building of new Whole Foods stores, but they will also want to appeal to demographics which are less likely to shop at that particular chain. The apparel category seems like a logical next move and we need to look no further than Kohl's for a likely suspect. In 2018, Kohl's partnered with Amazon to begin accepting returns and to open Amazon smart-home boutiques, so a takeover bid would not come as much of a surprise.

Outside of the US, Amazon will be targeting the grocery category, likely with an acquisition reminiscent of Whole Foods in the US. Europe may be a challenge due to recent European Commission attention on anti-competitive grounds. China continues to elude Amazon while India is regulating foreign companies like Amazon creating barriers to growth – further acquisitions will be necessary to compete in these very large growth markets.

But in predicting for the next major international acquisition, we are looking among the most innovative and capable ecommerce platforms in emergent regions. One possible contender is Rappi, an on-demand grocery delivery startup in Latin America with ambitions to become an 'everything store' – sound familiar?

Acquisitions outside of traditional retail are likely as well. Amazon has continuously strived to outdo itself in fulfillment capabilities, so as USPS, UPS and FedEx costs continue to rise, look for Amazon to acquire a logistics player. Days ago, investment firm DA Davidson suggested that gas stations would be a smart investment, and though we doubt this is currently in Amazon's plans, an acquisition in this space could be a boon to the retailer's distribution network. We know more major purchases are coming, but there's certain to be some surprises in the bunch.

Brand implications: Amazon's acquisitions have a tendency to cause a major disruption in the relevant sectors – nothing is Amazon-proof, so brands need to be careful not to underestimate the retailer.

8. Sustainable Packaging

In 2011, Amazon launched the experimental AmazonTote program, which gave residents in the Seattle area the option to have their packages shipped in reusable totes rather than in traditional cardboard packaging. This program didn't stick, but since then sustainable packaging has come a long way – and the consumer demand for sustainable business practices has grown significantly.

In September 2018, Amazon took a big step in this directly, notifying thousands of its North American vendors by letter of a new incentive program. This program, an update to Amazon's Frustration-Free Packaging (FFP) program launched in 2008, is designed to incentivize vendors to take the lead on reducing waste and damage and increasing the sustainability of Amazon's last mile.

We expect Amazon to do its part as well. The ecommerce industry has faced heavy criticism regarding its sustainability and the industry's most recognizable player is well aware that sustainability is "a win all around – it's good for business, the planet, our customers, and our communities." So it's likely that Amazon will reintroduce something similar to the AmazonTote program in the near future, whether using totes or some newer innovative form of reusable packaging.

Brand implications: The new vendor incentive program urges vendors to redesign their packaging in order to meet new stringent FFP guidelines, with an additional monetary incentive to early-adopter. This program, which official comes into effect on August 1, 2019, puts the onus on the vendor to improve Amazon's sustainability. Brands will need to move in this direction or risk falling behind the competition.

The Long Term

9. Monetizing the Last Mile

There's no doubt in our mind that Amazon will monetize its supply chain within the next five years.

We’ve already predicted that one of the retailer's next acquisitions is likely to be a logistics company, but even if that proves false we still expect them to begin using solely their own last mile capabilities in all metro areas in the US within the next few years. In light of the rising costs of third-party delivery, Amazon will keep building out internal distribution capabilities, from delivery vans to cargo jets to drones (maybe).

Once Amazon's last mile capabilities are fully established, they will not shy away from competing for business with legacy distribution players. Similar to how the AWS infrastructure was originally built to support Amazon's digital ecosystem and later monetized as a cloud computing platform, Amazon's physical infrastructure, built to support its supply chain and fulfillment, will eventually be sold to brands and retailers as a logistics solution.

Brand implications: The more fulfillment moves in-house, the more value Amazon will place on products that are 'Prime Pickable.' Brands should use location based analytics to ensure their products are moving though the supply chain to the end consumer as efficiently as possible – more efficiency means less cost to both Amazon and their suppliers.

10. 'Go' Anywhere

One of Amazon's most impressive inventions is the technology underlying its Amazon Go stores. With a combination of, according to Amazon, 'computer vision, deep learning algorithms and sensor fusion,' this technology is able to automate the customer's entire checkout process – all they have to do is walk into the store, pick up what they want to buy and walk out. The scanning of and payment for any items purchased is all handled behind the scenes, invisible to the shopper.

There are nine Amazon Go stores so far and Amazon has suggested they'd like to have 3,000 open by 2021. Research suggests that this would be a wise move: in their short lifespan, these 9 Go stores have generated 50% more revenue than the average convenience store of the same size. Taking the convenience store model and pumping in even more convenience has clearly paid off, but that's not the only advantage of Amazon's impressive 'just walk out' technology.

Arguably, revenue is secondary to data collection. The real competitive advantage of these stores is their ability to collect unprecedented amounts of data about shopping behavior. From how long it takes you to decide what to buy, to which products caught your eye as you passed them, to what path you take through the store, Go data could revolutionize store design.

With this in mind, we predict that Amazon will begin to white label the Go technology to other retailers, especially in international markets where they are unlikely to open their own stores. Amazon may charge an upfront fixed cost for the infrastructure or may collect a share of sales, but the revenue stream will not be the first priority. The main aspiration will be to use these third party retailers to gather even more behavioral data from shoppers around the world.

Brand implications: The data generated by Amazon Go stores could revolutionize in-store marketing, uncovering new insights about how and why shoppers notice (and purchase) the items they do – and forever changing the way brands market their products.

11. Disrupting Air Travel

Among those 3,000 Amazon Go stores planned for between now and 2021, several are set to appear in the top US airports. Hundreds of millions of people passed through the top 12 airports alone last year, so if each of those airports has a checkout-free Amazon Go store in it, that would bring the retailer a level of ubiquity that even now it can't claim. Additionally, Amazon Air continues to grow. Amazon has operated its own fleet of cargo planes since 2016 and recently leased 10 new aircraft which will bring their fleet size to 50 within the next two years.

But we believe that Amazon is planning a more direct disruption of air travel. In March, Morgan Stanley predicted that Amazon would reenter the travel industry after the shuttering of Amazon Destinations in 2015. It's likely that the retailer will introduce an airline travel site modeled after the .com marketplace, if not integrated directly with Amazon's main property, with the next two or three years.

Brand implications: Amazon's disruption of air travel will attract more business and corporate customers to the platform. B2B brands should stop shrugging off Amazon as a consumer-focused marketplace and start reevaluating the role it can play in helping them expand their business audience.

Amazon is very methodical. If you're paying attention (and we are!) nothing they do will come as a total shock. Whether it's an acquisition, a private brand expansion, or the monetization of one of its proprietary technologies, any major announcement will be preceded by months or years of data collection and testing. By monitoring Amazon's activity at all times, we can get a strong idea of their next moves.

For brands, these insights are a crucial part of developing a sustainable long-term strategy. Ecommerce moves fast and Amazon has an outsized impact on the entire digital marketplace – many of the retail and tech juggernaut's next steps outlined above will have an immediate impact on brand manufacturers. Accounting for these impacts is a major ingredient when it comes to remaining competitive in 2019 and beyond.

This insight was published with contributions from Edge by Ascential’s Danny Silverman, Pete Andrews and Jack O’Leary, and Flywheel Digital’s Patrick Miller.