Consumer Electronics: From Technology-Centric to Consumer-Centric

*YTD period in the report reflects January – mid December 2018

Technological strides in electronics are no longer limited to smartphones and computers but have also made their way into consumers’ everyday routines. From the booming popularity of Instant Pot and Alexa to the explosion of instant digital camera sales on Amazon, the definition of Consumer Electronics has expanded to factor in a crucial element that customers look for in their purchases: convenience.

As a result, brands are starting to invest more in technology to cater to the burgeoning consumer base obsessed with ultra-convenience. On Amazon, some of the most noticeable trends influenced by convenience are happening in Personal Care Appliances such as Oral Care and Grooming Appliances, as well as Small Consumer Electronics such as Digital Cameras and Headphones.

Upping the Ante in Oral Care

American consumers are expected to spend 21% of out-of-pocket healthcare spending on dental care alone. Americans seem to place a surprisingly high premium on healthy teeth and are willing to spend money on maintaining them. Since oral care doesn’t simply end with routine visits to the dentist, consumers want oral care tools that are effective and easy to use.

Although not quite a replacement for a dentist appointment, technological advancements in oral care appliances have made it possible to up the ante in oral hygiene with products like Powered Toothbrushes and Water Flossers, which together accounted for over $350 million in Amazon sales in 2018.

Oral-B, followed by Philips, have led Powered Toothbrush sales, growing 15% YoY. To inspire customers’ confidence in online shopping, both brands share similarities in having greatly detailed product page content showing variations of items and a seal of approval from American Dentists’ Association (ADA).

The main driver of growth for the category, however, were Water Flossers: an improved way of removing debris and plaque stuck between teeth by using water pressure, which is increasingly proving to be a better flossing option than traditional flossing. Water flosser sales grew by nearly 60% YoY on Amazon, with the top selling item in the entire Oral Care Appliances category being WaterPik’s Aquarius water flosser.

The growing braces-wearing adult population in US, currently estimated to be over 1.4 million, is likely contributing to this trend. Amazon’s powerful ad platform and recommendation engine also make it easier than ever to motivate shoppers to try these new products.

Oral Care Appliances brands can utilize the convenience of Amazon to their advantage. This could potentially be done by brands staying in the know of growing customer trends, and learning from content strategies implemented by leading brands on Amazon’s platform to understand the preferences of their audience.

Less Mess, More Convenient Grooming

Sales in the Grooming Appliances category on Amazon are mainly dominated by Men’s Grooming with about $300 million in sales, up 20% YoY. The growth in Men’s Grooming was interestingly brought about by Grooming Accessories, such as replacement heads for shavers and trimmers. Meanwhile, Women’s Grooming accounted for over $25 million in sales, up 14% YoY.

According to a Google survey report of 1000 individuals in US, only 30% of shoppers are likely to shop in-store for appliances and electronics, showing that online shopping is the popular choice when it comes to making purchases in this category. But the massive gulf in sales between Men’s and Women’s Grooming is likely explained by the tendency for males to make more online purchases than women, and to make more impulse purchases.

This category is also a clear illustration of the shift towards convenience, where the top selling item in the category is the Braun Electric Shaver, Series 7 (currently sells for $169.94). Amazon’s 30-day return policy and abundant customer reviews are likely combining to encourage more male shoppers to find out for themselves whether electric shaving is more convenient than traditional shaving.

Furthermore, unlike traditional shaving which requires repeat purchases of various accessories (like shaving cream, razors and blades), electric shavers are suited to “wet and dry” shaving, and merely require a charging outlet and the occasional set of replacement blades. The 40% YoY growth in sales of grooming accessories hints that customers are increasingly making repeat purchases of these replacement blades after their initial investment in electric shavers and are growing increasingly attached to convenience in shaving.

Both men’s and women’s grooming appliances also share the convenience attributes of being able to be used in and out of shower as well as with or without a shaving aid. Women’s Grooming is a bit more diverse than men’s as it includes hair removal and facial care, growing at 40% and 20%, respectively. According to a report, while only 35% of women own beauty appliances, 41% are interested in trying one. Just like men’s grooming appliances, this category also gains from insight into products through customer reviews on Amazon, which feeds into customers’ curiosity to help them make the final decision to make the purchase.

With the insights into varying shopping habits of customers based on gender alone, brands can adjust the customer-facing Amazon content strategy of their product pages accordingly. For example: men’s shaver brands should develop detailed content for their pages and try to get more reviews and ratings from their customers to capitalize on men’s impulse purchases. Leveraging the Amazon Advertising platform is also critical.

Similarly, to appeal to the curiosity of female buyers, brands should highlight return policy and satisfaction guarantee on their product page content.

Revival of Instant Cameras

Although the top selling item in the Digital Still Camera category was Fujinon’s Cine Lens, it can largely to be attributed to the item’s high price of $3799. Point and Shoot cameras, meanwhile, have lost 12% market share of the category. Indeed, the real story in this area is the rapid growth of the Instant Camera segment with over $50 million in YTD sales and over 65% YoY growth.

As photography has been digitized through smartphones, the Camera category has become bifurcated into high end equipment for professionals and hobbyists, and a retro trend towards Instant Cameras that offer convenience and immediate gratification. They also bring a heavy dose of nostalgia and vintage sense of ‘cool,’ enabling consumers to be able to feel and keep tangible copies of memories instead of stowing them away on their phone’s memory. Enter: Fujifilm Instax.Although the nostalgia of instant cameras is widely associated with the name “Polaroid”, Fujifilm has been able to capitalize since the patent expiration under the former brand in 1998, currently commanding about 80% in YTD market share of Instant Cameras on Amazon compared to Polaroid’s 11%.

Customers’ widespread association of instant photography with Fujifilm instead of Polaroid can also be felt on Amazon’s organic search results for “Polaroid camera,” which leads to a page filled mainly with Fujifilm Instax items. Polaroid is making a renewed attempt to reclaim the segment as a “revived retro” contender in the Instant Camera category.

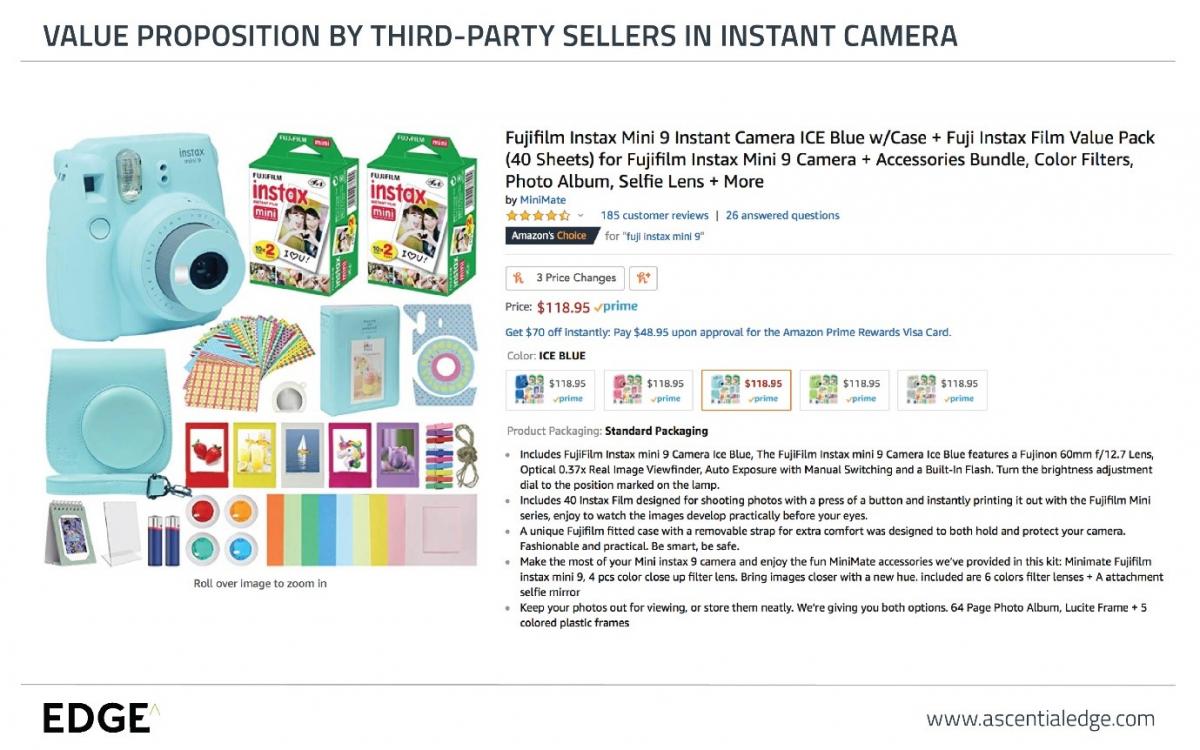

However, that is unlikely to be the most immediate threat to Fujifilm’s dominance, which is more likely to come from third-party sellers. Third-party sales surpassed first-party sales in mid-2018, with the most impact being felt on Black Friday, during which third-party sellers are estimated to have accounted for about 50% more sales than first-party sales.

These sellers have created bundles which include items like Instax camera, film, colored lenses, colorful frames and stickers. The bundles push the envelope on the overall value proposition by making it convenient for customers to shop for this trendy item and related accessories with one click. While Fujifilm also offers bundles, the third-party listings are cheaper in comparison, ranging from $94 to $118.5 against the brand’s $124.99

Fujifilm’s struggle to keep up with cheaper prices of third-party bundles serves a key lesson for brands on Amazon. The ability of customers to browse through several offerings can hurt first-party sales of brands if they are not actively optimizing customers’ Amazon shopping experience. These holes can create opportunities for third-party sellers to capitalize upon and decrease a brand’s Amazon market share.

Smart Home Assistant Enabled Headphones:

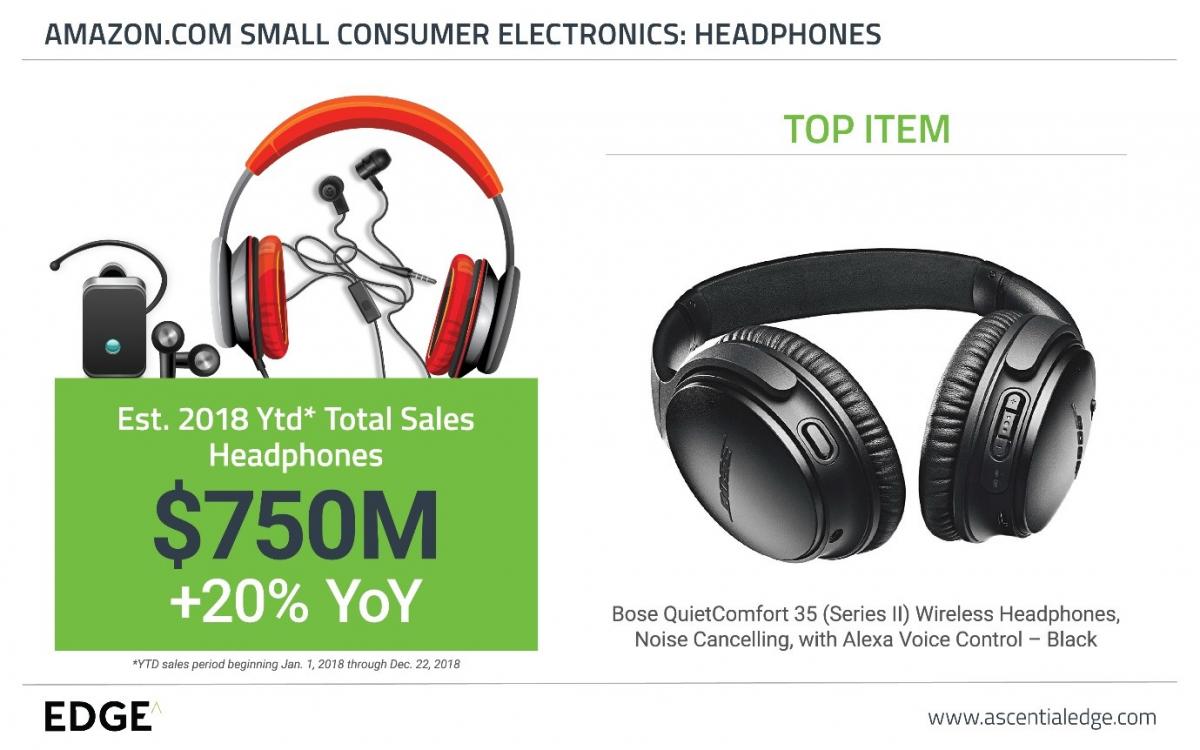

Portable gadgets and accessories have long been seen by consumers as a necessity, but the ubiquity of smart home technology means that the growing number of smart home assistant-enabled portable gadgets are in even higher demand, offering major convenience benefits to any consumer with smart devices. Total sales for Headphones on Amazon were about $750 million with 20% YoY growth. Bluetooth headphones dominated the category’s top 10 highest selling items’ list.

In 2018, 16% of adults in US were estimated to have smart speakers in the form of Alexa or Google voice control home assistants. Bluetooth headphones also accounted for 54% of total US sales in the headphones category in 2016 alone. This number is expected to have increased due to the widespread acceptance of Bluetooth headsets and the growing shift towards wireless headsets.

These figures point to the growing trends of smart home assistants and wireless headphones technology, further hinting at another trend: Smart home assistant-enabled headphones. Further accelerated by Amazon's announcement in January, 2018, that it was opening up its “Amazon Mobile Accessory Kit,” manufacturers are now able to create Bluetooth-enabled headphones and portable speakers that can pair with the Alexa voice assistant.

Brands like Bose and Jabra were amongst the first few brands to catch on to this trend and this foresight enabled the two to become leaders in the headphones category. Bose’s Alexa-enabled headphones ranked number one and four in the top ten for the category, and Jabra followed close behind with its own, Alexa-enabled Jabra Elite Active headphones.

The success of Bose and Jabra’s voice assistant- enabled headphones is a clear indicator for headphones brands that this technology is shaping a trend in the category. This should serve as a motivator to embed the technology into their products through Amazon’s Mobile Accessory Kit.

Technology Needs to Factor in Convenience

It’s clear that there are sweeping changes occurring throughout a wide variety of CE categories, - from oral care to cameras, and electric shavers to smart headphones. But there is one common variable that ties these products together: convenience. As technology advances, customers are looking for the most effective way to get through their routine and are finding products that allow them to do so.

Even revival of past trends needs to cater to convenience, not merely through technology but simplification of the shopping experience as well. Amazon’s vast product assortment gives customers the choice to browse through products and choose which ones get the “Buy Now” click.

When investing in technology to create new products, brands need to make themselves aware of the growing trends that are influencing shifts in customers’ tastes and preferences and seamlessly convey convenience through cultivating detailed content on product pages backed by customer reviews. While Amazon certainly provides the platform to showcase the technological enhancements, it is up to the brands to seamlessly integrate the value of these products into their messaging as well. After all, it is only brands that resonate with a customer’s convenience that will a place in the customers’ homes.