In our last piece, we discussed 'the battle for the countertop' in the context of small kitchen appliances. This race for space is not limited to appliances – it has an impact on every product category you can name – but it is arguably the most competitive in the kitchen. So, this week we're going to look at this trend through the lens of a small, often-overlooked category: Kitchen Accessories.

The race for space is a direct consequence of our current rapid urbanization. Globally, the majority of the population already resides in cities and within the next five years we expect nearly 500 million more people to make the move to an urban setting (United Nations, World Population Prospects 2018). This would bring global urbanization to approximately 58%, impacting consumer lifestyles in two very important ways. First, urbanization leads to a reduction in car ownership, which drives the demand for ecommerce. Second, households tend to get smaller – average household sizes in developed markets like Europe and North America have been trending toward more economy of space year after year.

In the kitchen, this trend is amplified. A real estate study conducted by Marsh & Parsons in 2014 was the first to measure and popularize this phenomenon, which it concluded is driven by consumers' changing eating habits and the reduced prominence of the kitchen as a social space. Peter Rollings, chief executive of Marsh & Parsons, summarized it as follows: ‘With less and less time spent preparing meals in the home, we are starting to see the kitchen completely disappear as a room in its own right. It is being subsumed into the wider living and dining space.'

Urban consumers are driven by convenience and are working with limited space. For brands, this means that earning their place in the consumers' kitchen is uniquely challenging. To win, brands need to convince consumers that they will make very good use of that space – and we can clearly see this race for space playing out on Amazon.com.

Don't let its small size fool you: the Kitchen Accessories category is fiercely competitive. It's a perfect example of what happens when a demand remains unmet by first party brands (1Ps), with two predictable consequences: one, third party sellers (3Ps) fill the void and come to dominate the category; and two, Amazon leverages its home-field advantage to meet the demand with new private label products.

Third Party Sellers

A 'first party seller' is when a brand sells their inventory directly to Amazon, who then sells it to the customer. 1P items appear on the platform with the label 'Ships from and sold by Amazon.com' and Amazon is the legal owner of the inventory prior to it changing hands with the buyer.

Alternatively, a 'third party seller' uses Amazon as a marketplace to sell directly to consumers. These items appear with the labels 'Fulfilled by Amazon' or 'Ships from and sold by (blank)' and the 3P is the legal owner of the product prior to making a sale. Brand manufacturers can and do sell through Amazon as 3Ps, but most 3Ps are resellers – they typically acquire their inventory by purchasing it directly from the manufacturer or buying it from other retailers.

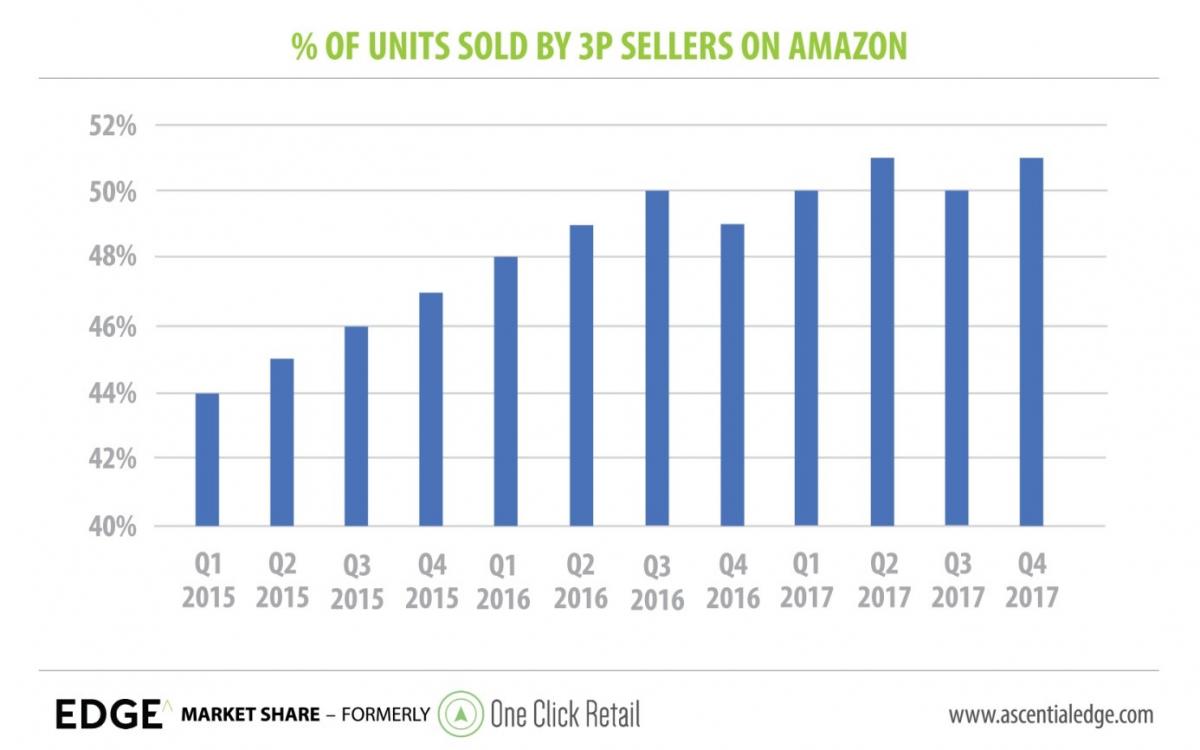

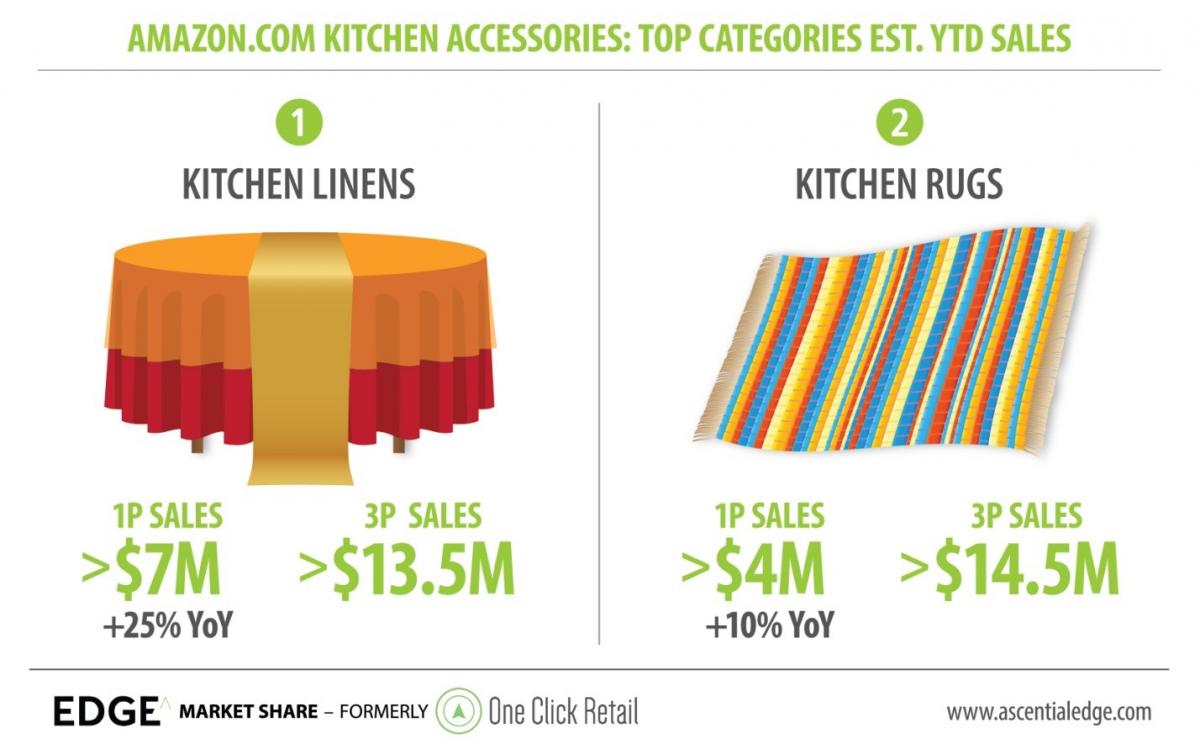

Today, Kitchen Accessories is a predominantly 3P category on Amazon.com. Year-to-date, 3Ps alone accounted for $50 million in sales by our estimates, almost doubling estimated YTD 1P sales of $27.5 million. This level of 3P dominance in a category remains rare, but it is becoming more common. 3Ps are gradually acquiring a larger share of the Amazon marketplace and in 2017, for the first time, they controlled more than half of Amazon's total sales volume.

This trend is taking place globally across marketplaces – according to Edge Retail Insights (formerly PlanetRetail RNG), the 3P market is forecast to 'account for 64% of global ecommerce sales added through 2022' – but the Kitchen Accessories category on Amazon.com is a perfect example of why this trend is gaining traction.

Kitchen accessories mostly consist of low-cost, low-volume items and have therefore been overlooked by major brands in favor of highly-trafficked categories. The common thread among successful 3P sellers on Amazon.com has been their ability to be first movers in an untapped niche.

To illustrate this, let's look at Kitchen Rugs, the #2 Kitchen Accessories subcategory. How is it that 3P sales more than tripled the sales of 1Ps? If we look at the three bestselling 1P items YTD (excluding Amazon private brands), provided by three different brands, we see that all three are decorative rugs. Alternatively, the much larger share of Kitchen Rugs controlled by 3Ps consists almost exclusively of ergonomic 'comfort mats' intended to help consumers withstand long hours in the kitchen (while also being stylish). This is a demand not being met by 1Ps, although it is now being met by...

Private Labels

Looking again at the top 1P items, we notice that of the 6 bestsellers, three of them are items from the AmazonBasics private label. Crucially, all of these items are ergonomic comfort mats including the bestselling 1P Kitchen Accessory of 2018 YTD, the AmazonBasics Premium Anti-Fatigue Standing Comfort Mat. This is a perfect example of how Amazon uses customer insights gleaned from 3P sellers to identify opportunities unmet by existing 1P brands and to fulfill those demands by introducing new private label items.

AmazonBasics is the leading brand in the 1P sales in both the Kitchen Rugs and Kitchen Towels subcategories. In both of those subcategories, 3Ps control more than two-thirds of total sales by our estimate, lending more credence to the argument that Amazon is using 3P success to identify opportunities for private label expansion. But even with the relative success of AmazonBasics, 1P sales in both subcategories are only growing at a rate of 10% year-over-year.

1P Opportunities

In Kitchen Linens, on the other hand, 1P sales are growing at 25% YoY. It's the largest Kitchen Accessories subcategory by total sales (although 3P sales are lower than Kitchen Rugs) and enjoys the highest growth YTD in 2018. This can largely be credited to savvy marketing from two key 1P brands.

First, LinenTablecloth produced nine of the top ten bestselling items YTD, in part thanks to its clever brand name which virtually guarantees a strong search performance by compounding two of the most competitive keywords used by its target audience.

Second, we have DII, which used long keyword-heavy titles to target consumers ahead of Thanksgiving and the holiday season, such as 'DII Cotton Buffalo Check Plaid Rectangle Tablecloth for Family Dinners or Gatherings, Indoor or Outdoor Parties, & Everyday Use'. Using this targeted content, DII was able to dominate sales of tablerunners and see a nearly 5 times increase in sales of its leading items from July to September.

Kitchen brands all want to be the next Instant Pot, but recreating that kind of phenomenon is like catching lightning in a bottle. Amazon is one of the most popular retailers in the world across all demographic measures, but the growing base of urban consumers with small living spaces is more is very particular about what products earn a place in their kitchens. The real opportunities going forward lie in identifying demands that have so far been neglected – being the first to fulfill a consumer need, however small and niche it may seem, is the single best strategy for kitchen brands looking to win in the race for space on Amazon.com.