The cost of being out of stock on a high-traffic digital retail platform during Cyber 5 could offset any benefit from the mega sales event

The domino effect of the pandemic is still occurring: COVID-19-related factory closures, shipping container chaos, delays at shipping ports, and global worker shortages across the value chain is the backdrop to the all-important Q4 trading period - for many businesses in retail the make-or-break for their financial year.

How are retailers reacting to the supply chain crisis?

Concerned that the severe logistics challenges would impact this year’s Black Friday and Cyber 5 weekend “mega-shopping” event, many retailers launched deals, discount programs and curated gift lists as early as October.

Amazon, Walmart and Target, Boots, John Lewis and Currys are just some of the many companies that launched pre-Black Friday sales to mitigate availability issues and they have been urging seasonal shoppers for weeks already to lock in sought-after gifts or potentially miss out and have to disappoint friends and family members.

Watch: Xian Wang, VP, Edge Retail Insight, speak about optimising Cyber 5 online as well as the growth of ecommerce and how brands can compete going into 2022

But as it turns out, in the US at least, deals have been much weaker across many categories, except for toys and computers.

Adobe Analytics data, which covers more than 1 trillion visits to US retail sites, 100 million SKUs and 18 product categories, shows that discount levels in electronics are at 8.7%, compared to 13.2% at this point last year; Sporting Goods are at 2.8% (vs 11.2%) and appliances are at 4.6% (vs 10.2%). Tools and home improvement are seeing no discounts at all, with prices in fact up 1.2%, compared to a 6.8% discount last year.

But even with smaller deals and inflation pushing up prices, availability is proving to be an issue. Data from the Adobe Digital Economy Index shows the prevalence of out-of-stock (OOS) messages rose 250% in October, when compared to a pre-pandemic period (Jan 2020), and when compared to two holiday seasons ago (Oct 2019), it is up 325%.

In October alone, consumers have seen more than 2 billion OOS messages online. Adobe says most of these come from electronics, jewellery, apparel, home and garden, and pet products. Our own data from Edge Digital Shelf, which covers 900 retailer sites in more than 60 countries also showed that in October and November product availability is suffering.

“Consumers are beginning to understand the real impact of the supply chain challenges,” said Taylor Schreiner, Director of Adobe Digital Insights. But what does being OOS really mean for brands?

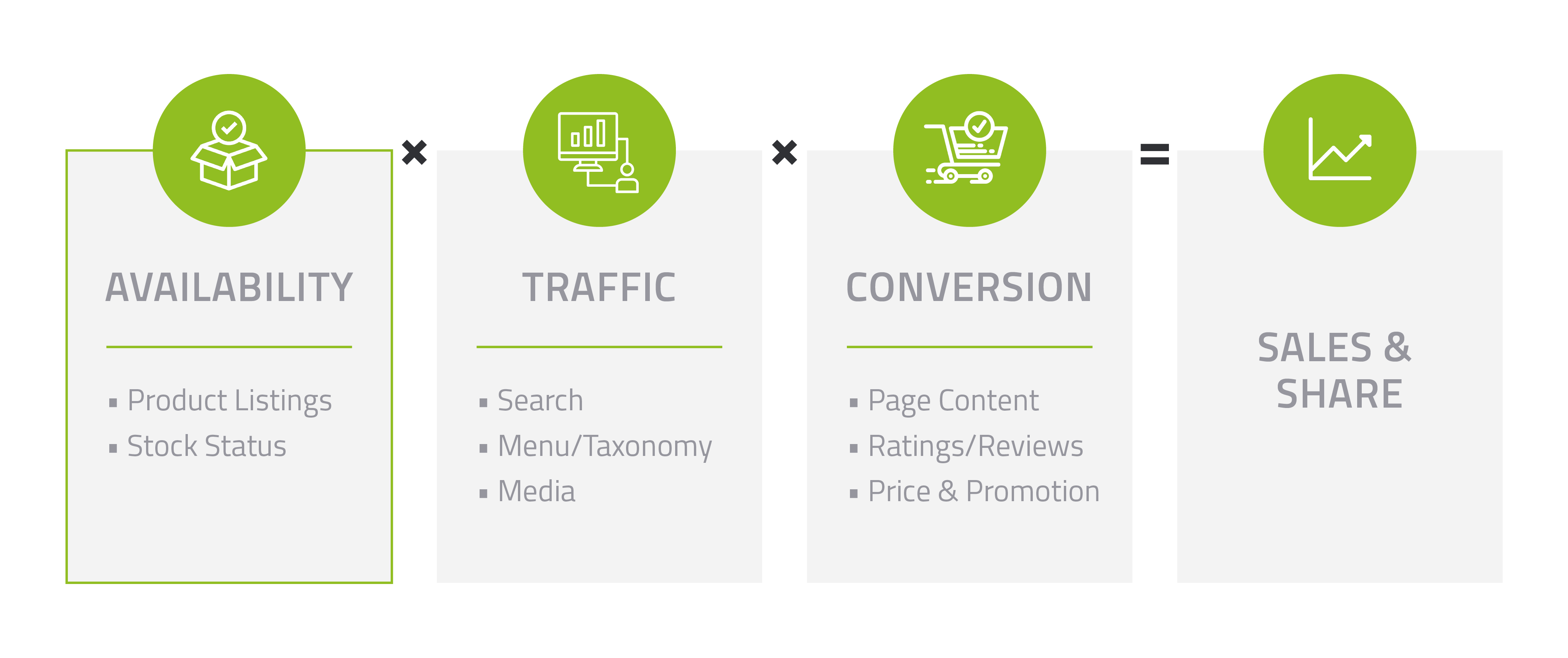

The Ecommerce Sales Equation

Being out of stock online is more costly than you think

Being prepared for Cyber 5 is a great opportunity to boost sales. Our analysts have discussed a few different tactical ways brands can leverage the boom in ecommerce and online browsing in previous blogs. But the truth is, all of the effort, investment and resources focused on optimising Black Friday, Cyber Monday and the days in between could be wasted if you do not have enough inventory for your most popular products and your shoppers are finding you but getting OOS messages.

It’s bad enough if your products are missing from a shelf in a physical store, but online the risk of being OOS can be even greater. The “endless aisle” of ecommerce means that the algorithms used by digital retailer platforms are built to automatically plug the “hole” left by an OOS product with the most suitable alternative. Competition is fierce on the digital shelf and the danger of running out of inventory is that impatient shoppers will quickly move on to a competitor if they don’t get what they want from you immediately.

Some retail platforms may be programmed simply to remove a product from search only while OOS and then once inventory is restocked, the product will be accepted back into the original search ranking right away. But some of the more sophisticated algorithms, such as Amazon’s, prioritize recent activity, like sales and conversion, and an OOS product has none. Essentially, being OOS on a platform like Amazon pretty much wipes out your product’s momentum.

Even if a product is OOS for just two hours, Amazon’s algorithm will have difficulty ranking it because recent sales history is one of the single biggest drivers of search results on the platform. The longer the stock out persists, the more difficult it will be to reboot the flywheel effect for the product as the Amazon algorithm focuses on a consistent user experience which requires consistent brand performance.

We have seen clients lose as much as a fifth - 22% - of their weekly sales for every day their product is OOS and that’s during a normal trading period. If a brand has to invest in sponsored search and promotions post-Cyber 5 to regain a rank on the first page of search for their most important terms, then they have not only lost the benefit of the high-traffic holiday but probably missed their business objectives for Q4.

Prioritize Amazon

If brands have enough inventory to either fulfil Amazon or a brick-and-mortar store (B&M), they should as a general principle fulfil Amazon first. The reason is, if they suffer an out of stock in a B&M, there is a hole in the shelf, but that hole gets filled as soon as the product comes in; the product doesn’t lose its space. But on Amazon, the hole gets filled with a different product, and you have lost your space until you can earn it back.

The longer you are OOS, the harder, longer and more expensive it is to get back. Fulfilling Amazon isn't about maximizing growth potential; it is minimizing long-term damage. So, the importance of inventory forecasting for Cyber 5 and beyond - don’t forget about the rest of the quarter - cannot be overstated.

So as the clock ticks down to Black Friday, some points to keep in mind to make sure you are doing everything you can to mitigate an OOS - through the capabilities that Amazon and other retail platforms offer as well as playing an active role in the last mile:

- Have you engaged your retailer about taking safety stock for peak?

- Have you listed alternative products on the same page as your top-selling lines to keep the shopper from moving off your page?

- Have you invested in sponsored display adverts to encourage people who can't find the product they are looking for, that you are the right alternative?

- What delivery safety nets do you have in place?

- Are there 3Ps that can cover if your retail partner suffers an OOS?

- Do you have drop ship capabilities to handle orders?

On Black Friday (26 November) and Cyber Monday (29 November) we will be publishing an on-the-day analysis identifying which brands in the key seasonal categories are winning search on the major retail platforms using our industry-leading ecommerce analytics software Edge Digital Shelf. Do look out for them.