It’s time to tear up the pre-2021 guide to success

The pace of change in the retail industry since the pandemic emerged has been nothing short of breakneck. To name just a few of the developments over the past year or so:

- Delivery intermediaries evolved into retail

- Ultra-rapid grocery delivery emerged, scaled and started to consolidate

- Automated urban micro-fulfillment centres - ‘dark stores’ - became a key component of mainstream grocery retail

- Checkout-free shopping gained momentum

- Direct-to-consumer (DTC) offerings multiplied and new DTC brands became serious contenders in their categories

- Social commerce, chat commerce and influencer-led live commerce - livestreaming - came of age

That’s just a handful of the ways retail has changed in just shy of two years. Then of course, there’s the much-hyped developments in the metaverse and Web 3.0, expected to be a standout theme at CES 2022 and potentially taking on more resonance as many countries once again embark on new programmes of social restrictions. Already, 2020 feels like a different planet.

Last Christmas, shoppers were buying their gifts online from retailer websites, but this year, they could be buying them from Tik Tok, Pinterest, Whatsapp or Twitter and ordering a last-minute cheese board, extra cranberry sauce or a bottle of whiskey on Christmas morning for at-home delivery before lunch.

%20-%20Copy.png)

The shopper path to purchase today

A new era of almost constant disruption - how can brands keep ahead of the curve?

The pandemic period lit the touchpaper on the growth in online shopping. Strategic investments in real-time data and analytics software, augmented reality and AI and reorganising organisation and team structures have helped forward-thinking retailers and consumer goods organisations to make faster, more informed and customer-centric business decisions in 2020 and 2021.

Amazon became a serious operator in online grocery; Carrefour, Boots and Tesco launched sophisticated media platforms to help brands maximise campaign strategies; Macy’s helped Toys R Us make a comeback with 400 of the latter to be integrated as shop-in-shops and Walmart pioneered capabilities in both social and traditional media.

Much like the omnichannel approach retailers and brands are taking, CES, the technology festival is going to blend both a virtual and in person experience to kick off in 2022. Every year, this show is one of the most exciting events to start the year, and should offer inspiration for what’s in store for shopping and the consumer experience in the year ahead.

I’m looking forward to the tech and innovation on display that will define the retail and shopper experience in 2022 and the years to follow. One thing is for certain. For consumer brands, the pre-2021 way of operating is over.

Do these 5 things to succeed in 2022 and beyond.

1. Think digital-first

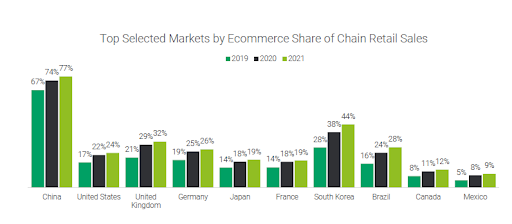

Edge by Ascential estimates that 63% of sales added globally over the next five years will be generated online - almost double the amount of all other store channels combined, according to forecasts published in the Edge Retail Insight report Future of the Digital Shelf, November 2021.

By 2026, ecommerce will reach almost US $5.7 trillion, up from US $3.33 trillion expected by the end of 2021.

The most successful consumer businesses will be those that adopt a digital-first mindset to maximise the ecommerce growth opportunity, but also the engagement, discovery and loyalty opportunity, with many purchasing journeys now beginning on a mobile phone, tablet or laptop, which are then frequently also used through that journey - even if the final purchase is made offline.

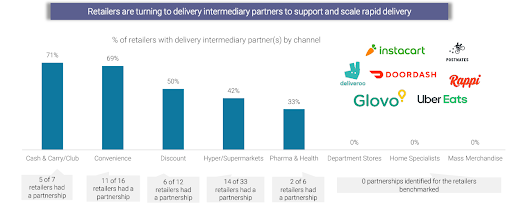

Using market, channel, retailer and category data, like the kind we have available through Edge Retail Insight, to understand who your biggest retail partners will be in the future will be critical. They could be either ecommerce-first platforms or omnichannel operators (with most of their sales still coming through stores, but with a rapidly growing online operation). They might even include delivery intermediaries, like Instacart, Uber Eats, DoorDash or one of the app-based ultra-rapid startups that didn’t exist a year ago. We anticipate that the delivery service channel could be worth more than USD 1 trillion by 2025, more than four times the size it was in 2020.

Once deciding who to partner with, brands must then learn the unique growth levers to succeed on each. Insight into how best to gain visibility on their digital shelf will be imperative. That may mean being included in exclusive membership programmes, like Amazon Prime, Walmart + and Kroger Boost, being climate compliant according to certain adopted sustainability KPIs or how to optimise the search functionality through content and images on your online product page.

Allocating advertising budget effectively on retail platforms in 2022 will also become critical as retailers develop into media and advertising giants using their own in-house capabilities or through strategic partnerships with adtech operators like Criteo and CitrusAd.

Warc, an Ascential agency that supplies data and forecasts to the marketing and advertising industry, anticipates that ecommerce-related media and advertising will be worth $137 billion by 2023, double what it was worth in 2020 and by 2023, digital commerce will lead global advertising spend.

Among other things, success in this environment will be predicated on advancing internal skillsets, rewiring organisational team structures to better align marketing, customer experience and ecommerce functions and rethinking KPIs.

2. Prioritise digital retail leaders

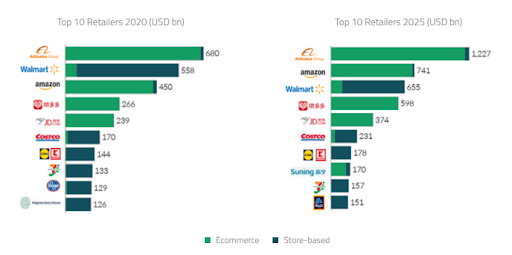

The shift to digital commerce is creating a new generation of retail leaders - those that prioritise digital innovation and fastidiously use data and analytics to better understand and be relevant for their customers. Today’s leading platforms, including Alibaba, JD.com and Pinduoduo in China and Amazon and Walmart.com in the Americas and Europe, are growing disproportionately ahead of other retailers.

In the US, Amazon and Walmart together accounted for almost a quarter of chain retail sales in 2020. Their gross merchandise value (GMV) sales by 2025 will be equal to about 50% of the total GMV sales in US chain retail. Global digital platforms could generate as much as 90% of ecommerce volume in just a few years.

Brands must master these fast-growing retail platforms, their flywheel and algorithm dynamics, to dominate in their categories.

3. Experiment with new channels and formats

The social isolation of lockdowns saw mobile phone and tablet usage soar as the only socialising permitted was virtual. People turned to their phones and social media for company, for entertainment, for information as well as to catch up with friends. Some consumer brands and retailers quickly spotted the potential gold mine of leveraging Tik Tok’s viral short video and influencer platform - among others - to create stimulating content for new audiences as well as strengthen loyalty with existing customers.

In China, which pioneered entertainment in ecommerce, will see social commerce generate an estimated US $351.65 billion in sales in 2021. Livestreaming, a more dynamic and exciting version of the 1980s home shopping TV network, will account for about a fifth of China’s total ecommerce sales this year, according to Warc.

Platforms like Facebook, TikTok, Instagram, WhatsApp, Pinterest and Snapchat have taken note. They have started to add features that will monetise their fast-expanding customer base and make it easy for their users around the world to shop when they are inspired. The capacity to in-app purchase and livestreaming functionality provide inspirational, digital-first ways to engage new audiences and build excitement and loyalty around brands and new products.

4. Invest in technology, innovation and analytics (test and learn will be key)

Future-proofing for the long-term requires constant investment from businesses as they adapt to the disruption and swings in consumer demand.

Retailers are investing to advance digital shelf capability, upgrading legacy systems and speeding up the supply chain. In-store technology and last-mile automation are key priorities and the ‘Amazon effect’ on the market is making technology trends move faster.

Amazon, Tesco, Intermarché and Rewe are prioritsing investment in checkoutless stores, demonstrating the rapid pace of change as tech-savvy shoppers drive increasing demand for these frictionless in-store experiences. As computer vision technology advances, we can expect installation costs to lower and an increasing number of rollouts and partnerships. One significant example is Sainsbury’s in the UK striking a deal with Amazon to integrate Amazon’s trailblazing Just Walk Out technology in its stores.

Amazon again leads the way in demonstrating how online shopping behaviours can create new service lines online and offline. Amazon’s 4-Star store, which recently expanded outside of the US into Europe, is curated based on the bestselling and most recommended products in its online assortment. QR codes are displayed next to products, allowing shoppers to access additional reviews and product information. Just this week Tik Tok has said it will go into the hot food delivery business in 2022 in the US with dishes on the menu to include those that have gone viral on its site, which is used by 1 billion people.

Amazon’s 4-Star store at Bluewater, Kent presents high levels of digital engagement and interaction for consumers

Retailers are investing in augmented reality (AR), computer vision, digital payments and robotics in the supply chain and brands must develop closer and more strategic relationships

with their retail partners to be included in pilot initiatives and priority programmes.

5. Integrate ESG throughout operations

Responsible retailing and ESG principles will be table stakes in 2022.

Reducing damage to the planet is now an essential consideration for consumers, retailers and policy makers. Even Alibaba was keen this year to show that it has a green side.The world’s largest retailer and owner of Taobao.com and TMall put an enormous amount of emphasis and focus on sustainability and social responsibility in its pre-2021 Singles Day (11:11) messaging and initiatives. It had a dedicated page for eco-friendly, low-impact products during the 11.11 sales and gave away RMB 100 million worth of “green vouchers” to incentivise sustainable purchases during the 11-day event. According to Alibaba’s figures, more than 2.5 million consumers purchased green products during 11.11.

More than ever before, consumers are looking to business to help solve the climate emergency and help them lighten their environmental impact and retailers are responding with commitments to net zero carbon emissions, renewable energy, low-emission transport and the elimination of plastic packaging. To be achievable, these targets require effort across the entire value chain, which means that suppliers must respond with their own targets and embed ESG KPIs into business goals.

In a recent article on the sustainability imperative in retail, we go into more detail about how Amazon’s Climate Pledge programme is quickly setting new standards with regard to climate compliance and how a “planet first” approach may actually be directly revenue accretive.

We expect to see acceleration in sustainability commitments from retailers and brands, but the key will be making it easy for shoppers to access products, services and information to help them make responsible purchase decisions.

Will you be at CES? To hear more about how suppliers can succeed in an era of retail disruption and optimise for success in a digital-first shopping landscape, book a meeting with Xian Wang, VP, Edge Retail Insight, Edge by Ascential.