In our Health, Beauty & Personal Care Sector Report, we examine the latest trends and developments in the health and beauty sector – which is expected to see a whopping 15% CAGR in online sales by 2023 – and share our expert recommendations on strategies your brand can implement to capture this growth.

Leading Specialists Compete in a Highly Concentrated Health & Beauty Sector

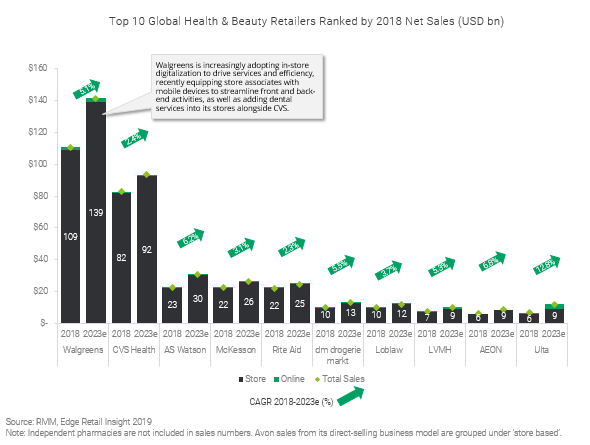

Walgreens and CVS dominate the health, beauty & personal care sector, making up 64% of the sector’s sales in 2018. They are also driving innovation in the health & beauty sector by rolling out major in-store and digital initiatives aimed at building out omnichannel capabilities. With global consolidation a key trend within the sector, smaller specialists will need to invest in their fulfilment capabilities and broader health & beauty service offerings to compete over the next five years.

Further, ecommerce sales for the sector are expected to grow at 15% CAGR by 2023 in comparison to only 4% for store-based sales, which shows that brands need to invest in strengthening their online capabilities to cater to customers’ shift towards the digital shelf.

Major Global Pureplayers are Expanding into Health & Beauty

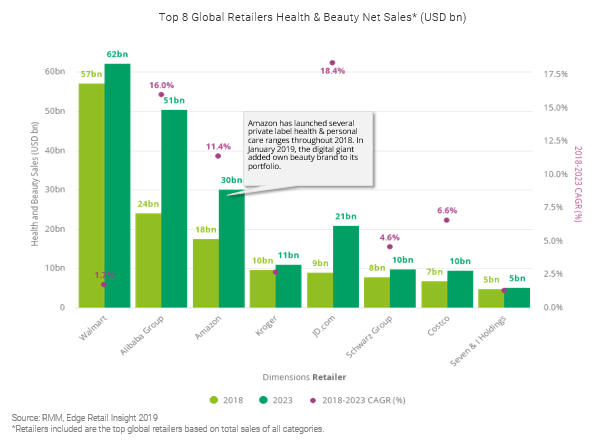

Outside of health and beauty specialists, other top global retailers are also looking to extend their footprint into the health and beauty sector. Pureplay retailers like Alibaba, Amazon and JD.com are projected to see double-digit growth in the category over the next five years, thanks to a range of recent initiatives such as Amazon’s new private label beauty range.

To stay competitive in the face of such challenges, health & beauty retailers will need to maintain a strong online assortment and added value proposition through in-store service.

Looking for the full, 45-page Health, Beauty & Personal Care CPG Sector Report?

Coverage includes:

- The expected ecommerce penetration of the health & beauty category and the impact of recent moves from pureplay retailers including Amazon, Alibaba and JD.com

- The latest retailer and supplier initiatives across the health, beauty & personal care sector, covering a range of relevant product categories including OTC, cosmetics, fragrance and oral care

- Insight into global markets that are experiencing the fastest growth in health, beauty & personal care, with Asia-Pacific leading the charge

- The increasing focus on the in-store experience and services, with leading retailers investing in in-store services and interactive experiences to differentiate from online and drive physical footfall

Find out how Edge by Ascential™ can help you master the Health, Beauty & Personal Care Sector, arrange a call with one of our Data and Insights experts today, and we will send you the full 45-page Health, Beauty & Personal Care report.