By Nathan Rigby, VP Sales and Marketing at One Click Retail

It's finally time to start thinking about spring. With the vernal equinox less than a month away, Lawn & Garden brands are preparing for their high season. Increasingly, these brands are finding the most success on Amazon; even for products traditionally dominated by large brick-and-mortar retailers, today's consumer prefers to do their shopping online. With an estimated $2 billion in US sales, Amazon's share of the Lawn & Garden market is significant – and is growing.

In recent years, Amazon has been turning its attention to the needs of homeowners. Consumers in Amazon's core demographic – millennials – are entering homeownership in growing numbers and shifting their buying habits as they invest in a stable and comfortable home life. As Lawn & Garden becomes one of the key product groups for this demographic – which holds a huge amount of trust and loyalty toward Amazon – it causes a shift in marketshare away from brick-and-mortar incumbents like Home Depot in favor of Amazon.

Brands that invest in Amazon today have the opportunity to capture a new audience – an audience that is going to be the major Lawn & Garden buying power for years to come.

What's Big: Gardening

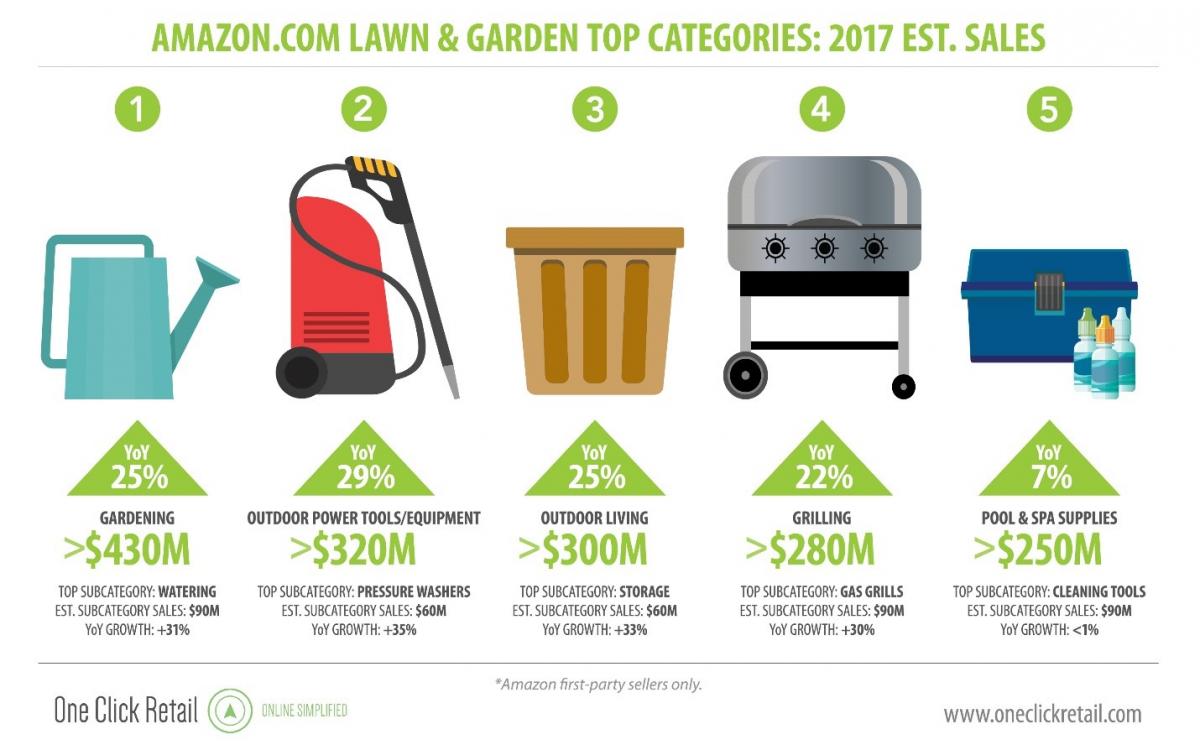

The major Lawn & Garden category – with nearly a quarter of total product group sales – is Gardening. At an estimated worth of $430M in 2017, it is the largest category by a wide margin, and with 25% YoY growth it is likely to stay that way.

Watering is the leading Gardening subcategory with an estimated $90M in sales and 31% growth. The category is led by the Rachio Smart Sprinkler Controller, a WiFi- and Alexa-enabler sprinkler control system. As the #1 item in the Watering category and the #5 Lawn & Garden item overall, Rachio's success reveals how home automation is a huge competitive advantage for brands.

Brands across all product groups have had success by taking everyday items and integrating them with Alexa, Amazon's voice-activated personal assistant originally developed for the Echo smart speaker. But this trend is most powerful in home automation, where Alexa-enabled thermostats, lamps and sprinkler systems have captured the public's imagination. Today, home automation is a major purchase motivator for consumers and an opportunity for brands in the Lawn & Garden space to stand out from the competition.

What's Growing: Pressure Washers

The Outdoor Power Tools/Equipment category, which contains pressure washers, lawn mowers, snow/leaf blowers, and other such machines, is the #2 category overall and is growing at a faster rate than any other category in the top 5. Fully 20% of the estimated $320M in sales was for Pressure Washers, which is also the biggest growth driver with a 35% YoY increase in sales during 2017.

Sun Joe is Amazon's leading brand in the Pressure Washer space and produced the #1 Lawn & Garden item of last year, the Sun Joe SPX3000 Electric Pressure Washer. A similar model, the SPX3001, also ranked as the #7 item of 2017. The Simpson brand also did very well in this category with their gas-powered pressure washer ranking as the #4 Lawn & Garden item of the year (Pressure Washers was the only subcategory to have three items appearing in the top 10).

|

|

Top Items #6-#10 |

|

6 |

Greenworks Twin Force Cordless Lawn Mower |

|

7 |

Sun Joe SPX3001 Electric Pressure Washer with Hose Reel |

|

8 |

Advion Syngenta Cockroach Gel Bait |

|

9 |

Mac Sports Collapsible Folding Outdoor Utility Wagon |

|

10 |

Polaris Vac-Sweep 280 Pressure Side Pool Cleaner |

*Amazon first-party sellers only.

What's Stable: Gas Grills

With the #2 and #3 bestselling items last year, it's clear that Gas Grills aren't going anywhere. A consistently strong subcategory, Gas Grills makes up nearly a third of Amazon's total sales in the Grilling category, and sold 30% more in 2017 than in the previous year. The leading brands in this space were Blackstone and Weber with the #2 and #3 Lawn & Garden items respectively, with Char-Broil also having a gas grill rank in the top 15.

Charcoal grills, requiring more time and skill to use, did not rank among the top 25 items in 2017. This may be explained by the generation; most homeowners buying their Lawn & Garden supplies on Amazon are young professionals, many of whom work long hours and choose their purchases based on their value as time-savers. For example, the content on the bestselling item's page reads:

"You'll be cooking in no time. Eliminate the hassle of kerosene, charcoal and matches... With the simple push of a button your griddle is ready to go." (Blackstone 36 inch Outdoor Flat Top Gas Grill Griddle Station)

Just like in kitchen appliance, the most successful brands in Grilling are those that appeal to today's busy Amazon shopper.

What's Next: Portable Generators

The emerging category of 2017 was Portable Generators, nearly doubling in size to earn an estimated $30M in sales, almost half of the category total for Generators. These products – led by the WEN 56200i Super Quiet 2000-Watt Portable Inverter Generator – are very popular among campers and people working outdoors.

The success of Portable Generators in 2017 is consistent with consumers trends toward both outdoor living and DIY – two trends which have had a major effect on the Lawn & Garden market. As Amazon shoppers enter home ownership and spend more of their time outdoors, they take on lawn maintenance and gardening as hobbies, grow and cook more of their own food, and invest in the cleanliness and outward appearance of their houses.

These are hobbies that last a lifetime and Amazon already has a firm foothold on the market. Brands have an opportunity to join a new generation of consumers who prefer Amazon over the brick-and-mortar alternatives and to evolve with the latest trends such as home automation. As long as millennials keep earning more money, buying homes, and using the internet to purchase just about anything, Amazon's sales will continue to grow.

One Click Retail is the industry’s most accurate source of sales data for the world’s top eCommerce marketplaces. Using a combination of website indexing, machine learning and proprietary software, OCR estimates weekly online sales figures with market leading accuracy in order to deliver the best insights, analytics and strategies to their brand manufacturer clients. To catch a glimpse of how OCR gives brands critical edge on online platforms with our unique data and expertise, subscribe to our weekly eCommerce insights blog, and follow us on Twitter and LinkedIn.

If you are a brand manufacturer who would like to learn more about how you stack up to the competition—or would like to see your market share and category growth insights— fill out the form on the right or email us at info@oneclickretail.com for a free capabilities demo.