By Nathan Rigby, VP Sales and Marketing at One Click Retail

With the vernal equinox less than a month away, it's time to start thinking about spring. As Lawn & Garden brands prepare for the high season, they are increasingly discovering their greatest sales opportunity is Amazon. In a product category once dominated by brick-and-mortar garden centers, European consumer is increasingly turning to Amazon.co.uk, Amazon.de and Amazon.fr to do their shopping online. With sales estimated at nearly €300 million, Amazon's share of the European Lawn & Garden market is significant – and is only getting bigger.

Both in Europe and in North America, Amazon has been turning its attention to the needs of homeowners. With more young consumers buying houses, homeowners are shifting their buying habits and Lawn & Garden is becoming a key product groups for millennials – a demographic that holds a huge amount of trust and loyalty toward Amazon. As European brick-and-mortar chains see their marketshares dwindle, Amazon brands that invest in Europe today have the opportunity to capture a new audience – an audience that is going to be the major Lawn & Garden buying power for years to come.

What's Big: Grilling

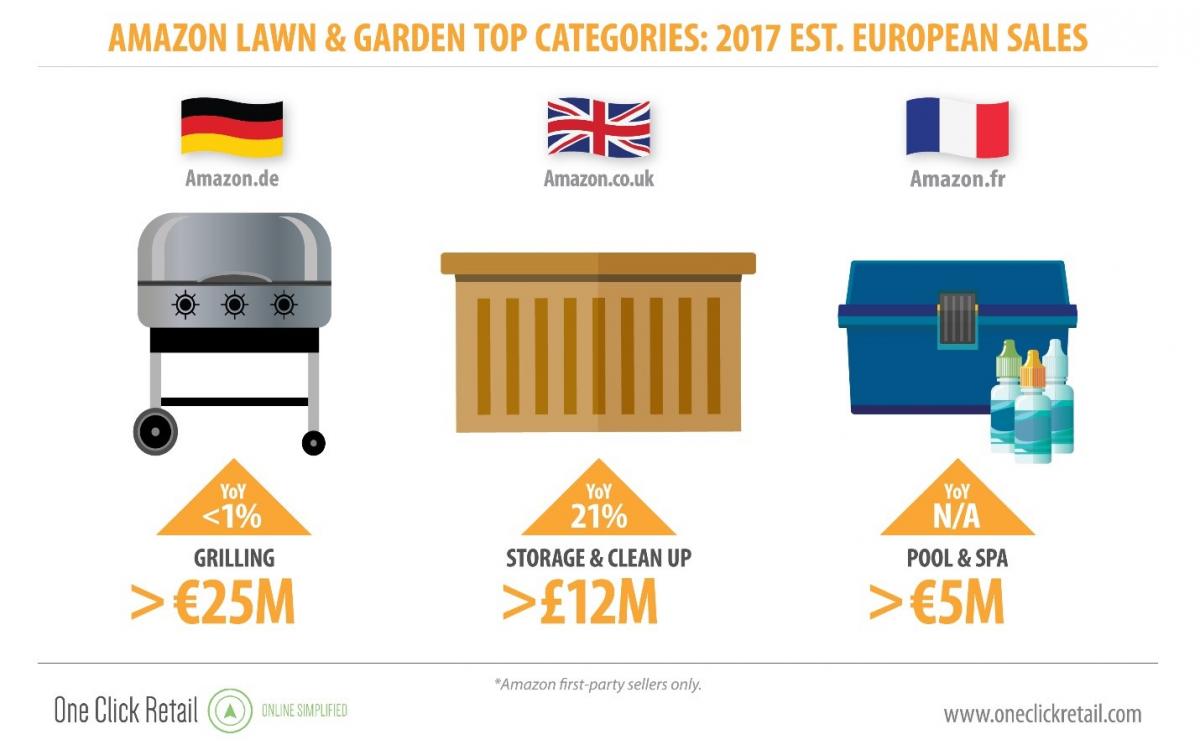

Amazon's German marketplace, Amazon.de, is the largest of the retailer's localized European site and thus is responsible for the largest share of sales in most product groups. In 2017, the Lawn & Garden product group in Germany brought in €175M in sales, nearly twice as much as in the UK.

Grilling was last year's leading category, responsible for €255M in sales. In contrast to the trend toward Gas Grills in the US, the Charcoal Grill subcategory outperformed Gas Grills in Germany, the UK and France. The bestselling grill in Germany and the UK, the Toronto Trolley Grill Barbecue from German brand Tepro, was also the single biggest selling Lawn & Garden item of the year in Germany and is listed as "Amazon's Choice" in both countries. In France, the same item was the #2 grill of the year, behind a countertop electric grill from Severin, another German brand.

Though the European grill market is dominated by German brands Tepro, Severin and ProfiCook, the leading grill is marketed as an "American-style grill" and (strangely) titled "Toronto". This poses an interesting question as we enter barbeque season: are North American brands missing an opportunity in Europe? With charcoal barbeque sales falling in the US in favor of gas grills, Europe may a place they can recover those lost sales.

Top Categories

What's Growing: Gardening

As more millennials enter homeownership, this eCommerce-savvy generation is taking on a whole new set of household hobbies. With the popularity of gardening among Amazon customer increasing, it's driving growth across a range of Lawn & Garden categories.

Watering is now the third-largest category in both the UK and Germany with YoY growth of 50% and 13% respectively. After Watering, Pest Control is the fastest-growing category in the UK and was responsible for two top ten items in Germany. Shears/Pruners is the largest Tools subcategory with a YoY growth of 58% and 31% in the UK and Germany respectively.

In Germany, the #2 bestselling item of 2017 was 2-in-1 weed killer and lawn fertilizer from Wolf and two other pest control products ranked in the top 10. In both Germany and France, an automatic watering system from Gardena was a top 10 item. Even the Storage category is driven by Gardening, with Keter brand sheds – marketed as "Garden Storage Sheds" – making up four of the top 5 Lawn & Garden items of 2017 in the UK.

Well-manicured outdoor spaces are a big part of European culture and a whole new generation of consumers is beginning to take this on as a pastime. Gardening is a hobby that lasts a lifetime and brands today have an opportunity to capture the loyalty of young consumers through Amazon.

|

Lawn & Garden: 2017 Top Items |

Category |

||

|

Germany |

1 |

Tepro Toronto Trolley Grill Barbecue |

Grilling |

|

2 |

WOLF Garden 2-in-1: Weed Killer + Lawn Fertilizer |

Seeds & Plants |

|

|

3 |

Netatmo Weather Station for Smartphone & Amazon Alexa |

Weather Stations |

|

|

UK |

1 |

Keter Store It Out Max Outdoor Plastic Garden Storage Shed |

Storage & Clean Up |

|

2 |

Keter Store It Out Midi Outdoor Plastic Garden Storage Shed |

Storage & Clean Up |

|

|

3 |

Lay-Z-Spa Saint Tropez Inflatable Hot Tub + Floating LED Light |

Pool & Spa |

|

|

France |

1 |

Netatmo Weather Station for Smartphone & Amazon Alexa |

Weather Measuring |

|

2 |

Intex Sand Filter - Gray |

Pool & Spa |

|

|

3 |

Intex PureSpa Filter Cartridges – Set of 2 |

Pool & Spa |

|

*Amazon first-party sellers only

What's Stable: Pool & Spa

France is a significantly smaller market for Amazon than either the UK or Germany. While we do not have YoY growth data for 2017 in Lawn & Garden, nearly every other product group we've looked at has shown significantly higher rates of growth on Amazon.fr than on the retailer's other European sites, and we suspect that this product group is no different.

This suggests that the smaller French market is rapidly "catching up" to the larger European market – but our data also reveals some trends that are unique to France. For example, Pool & Spa ranks as the #1 category in France (by a significant margin) while ranking among the top five in either Germany or the UK.

Out of the 10 top Pool & Spa items in France – all of them ranking among the 20 bestselling Lawn & Garden items of 2017 – 9 of them come from the Intex brand specializing in above-ground pools. Intex also has the #1 Poll & Spa item in Germany. In both countries, a high share of sales are for new pools, which means that these customers will keep returning to Amazon to purchase cleaning supplies, accessories, and other pool maintenance products.

In the UK, Intex is outperformed by Laz-Z-Spa, a brand specializing in inflatable hot tubs with each model inspired by a different city: Saint Tropez, Vegas, Palm Springs and Paris. This is an innovative design especially suited to young consumers who may be limited by both cost and space in their ability to invest in a pool.

With so many Europeans investing in pools and hot tubs, it's an example of how brands that capture Amazon shoppers early will be rewarded by their loyalty in the long term. This is a winning strategy for brands to follow across all Lawn & Garden categories.

What's Next: Home Automation

Brands across all product groups have had success by taking everyday items and integrating them with Alexa, Amazon's voice-activated personal assistant originally developed for the Echo smart speaker. In Europe, the Netatmo brand has leveraged this competitive advantage with their WiFi- and Amazon Alexa-enabled Weather Station, which was the bestselling Lawn & Garden item of 2017 in France and the #3 item in Germany, Amazon's biggest European market.

In both Europe and North America, our data shows that Amazon Home Automation is a powerful emerging trend, with Alexa-enabled thermostats, lamps and sprinkler systems capturing the public's imagination. Home automation is rapidly becoming a major purchase motivator for consumers and an opportunity for brands in the Lawn & Garden space to innovate and stand out from the competition.

Amazon's 2017 sales in Europe were consistent with ongoing (and strengthening) consumer trends toward both outdoor living and DIY – both of which have had a major effect on the Lawn & Garden market. As young Europeans enter home ownership and spend more of their time outdoors, they take on landscaping and gardening as hobbies, grow and cook more of their own food, and invest in their properties.

These are hobbies that last a lifetime and Amazon already has a firm foothold on the market. Brands have an opportunity to join a new generation of European consumers who prefer Amazon over the brick-and-mortar alternatives and to evolve with the latest trends such as home automation. As Amazon's European markets continue to grow rapidly, brands within and outside of Europe will have the opportunity to reach a huge new audience through Amazon.

One Click Retail is the industry’s most accurate source of sales data for the world’s top eCommerce marketplaces. Using a combination of website indexing, machine learning and proprietary software, OCR estimates weekly online sales figures with market leading accuracy in order to deliver the best insights, analytics and strategies to their brand manufacturer clients. To catch a glimpse of how OCR gives brands critical edge on online platforms with our unique data and expertise, subscribe to our weekly eCommerce insights blog, and follow us on Twitter and LinkedIn.

If you are a brand manufacturer who would like to learn more about how you stack up to the competition—or would like to see your market share and category growth insights— fill out the form on the right or email us at info@oneclickretail.com for a free capabilities demo.