By Ojastro Todd, Marketing Analyst at One Click Retail

In recent years, Amazon has become increasingly well known for its private brands. In addition to selling everything from A to Z, it seems the largest online retailer in the US intends to produce everything as well. From smart speakers to t-shirts to trail mix, Amazon’s private brands are appearing (and succeeding) across a wide variety of product groups. What industry will they target next?

Amazon has developed a clear strategy for private brand expansion. By understanding this strategy, we've been able to identify which categories meet Amazon's requirements, and with this information we've predicted three areas most likely to be the next targets for Amazon's private brands:

-

Pet Carriers

-

Diapers

-

Patio Heaters

To explain how we've reached these three most likely candidates, first we must explain Amazon's private label strategy using past examples and performance figures. There are three stages in the launch of a private brand: first Amazon will Release Sample Products, then Monitor Performance often for a period about a year, and finally the highest performing product lines will receive a Full Category Release. Let's breakdown this process in detail.

Amazon’s Private Brand Strategy

-

Release Sample Products

In September of 2017, Amazon relaunched Mama Bear, its private baby care brand. Initially launching with low-cost diaper genie refills, the brand introduced diapers in November 2017 and baby food a month later, minimizing the investment by initially producing only a small number of options in each category. By releasing a variety of products in quick succession, Amazon is able to collect a large amount of data in a short period of time, helping it to quickly make decisions and determine which products generate the most consumer interest. .

During this stage, Amazon will often utilize a promotion to kick-start a new product line. For almost the entire month of February, Mama Bear diapers and baby food were available at a 20% discount, resulting in almost $200K of baby food sales and over $650K in diaper sales during the promotional period. This gives a private label an initial boost, and whether or not this generates a long-term lift is a major indicator of the potential profitability of a category.

-

Monitor Performance

Amazon typically allows sample products to spend anywhere from six to eighteen months on the digital shelf before making any decisions. During this time, Amazon collects all the necessary data to determine its next move, dividing product lines into three categories. We can see examples of all of these within the Happy Belly brand one of Amazon's major grocery brands:

-

Failed Launches: Happy Belly spices can be considered a failure with only $200K in 2017 estimated revenue and no growth over the course of the year. Currently only 3 SKUs are still available on Amazon and they are likely to be discontinued once they go out of stock.

-

Stable Categories: Happy Belly eggs did very well despite only have a single SKU available. The product generated $1M in estimated 2017 revenue thanks to steady growth throughout the year. While not successful enough for Amazon to double down in this category, they will continue producing the item and monitoring growth and may decide to invest further at a later date.

-

Winning Categories: Soon after the launch of Happy Belly's sample products, it was clear that their trail mix line was a winner. The brand was generating strong sales and growth that revealed a potential to become one of the largest trail mix brands on the platform. Eight months after launch, Amazon tripled their selection with 40 new trail mix and snack nut options, resulting in a 600% increase in sales and $5M in estimated 2017 revenue.

-

Full Category Release

After identifying the winning categories, Amazon will follow-up with a mass release of new products. This will typically be supported by strong advertising, including AMS, AMG, email campaigns, and front page advertising (for example, the fall line of private brand apparel launched with a large, animated advertisement on the home page). Amazon may also offer a promotion to help generate interest and awareness of the expanded product line, resulting in an immediate lift in sales to match the increase in the number of items available.

This rapid investment in top categories is incredibly prevalent in Amazon’s largest and most diverse private brand, AmazonBasics. The brand initially launched with three major categories, Batteries, Laptop Cases, and Closet Storage & Organization, which at the start of 2015 were selling approximately $180K, $150K and $140K per week respectively. In July of that year, Amazon more than doubled their selection of batteries, triggering renewed growth which drove AmazonBasics to become the platform's largest battery brand with over $25M in estimated annual sales.

In January 2016, AmazonBasics repeated the same feat with their line of Laptop Cases – again causing sales to double almost overnight – and followed that up by tripling its selection of Closet Storage & Organization products, bringing sales over $6M in Q1 of 2018 and making AmazonBasics the category leader.

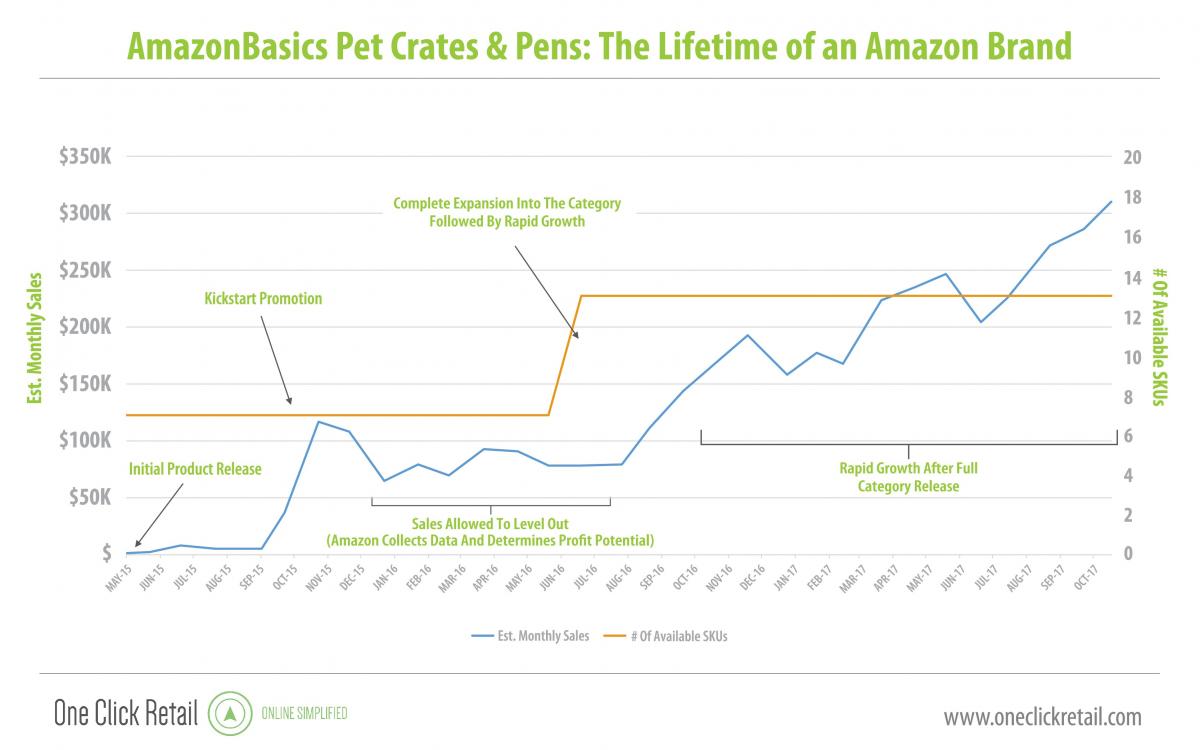

By way of illustration, we've mapped the lifetime of AmazonBasics' expansion in the Pet Crates & Pens category in the below chart, from the sample product launch through the full release and beyond. You'll notice that between the sample launch and full category release the product line was allowed to level out for about 14 months while Amazon collected data and expanded in higher-priority categories such as luggage and laptop carrying cases.

Predicted Product Line Expansions

That brings us to our predicted product line expansions. We've identified three categories where we can expect Amazon to expand their lineup in the near future, and we'll show you why.

AmazonBasics Pet Carriers

Expansion expected: Imminent

Amazon has its eye on the Pet category. In summer 2016, there were two major expansions under the AmazonBasics brand – Pet Beds and in Pet Crates & Pens – and since then there has been a steady introduction of more sample products in Dog Food Bowls (September 2016), Slow Feeder Bowls (February 2017) and Pet Feeders/Waterers (November 2017).

AmazonBasics Pet Carriers, though still in the monitoring phase, brought in $2M in estimated 2017 sales, a YoY growth of 80%, and produced the top four bestselling Pet Carriers of 2017. Though all their items are top performers, the brand is only #4 in this space because they have too few items available (the category is worth an estimated $16M). Therefore, the introduction new sizes and varieties of Pet Carriers is a major growth opportunity for Amazon, and we expect it the expansion could happen any day now.

Mama Bear Diapers

Expansion expected: Within 12 months

Amazon is looking for a second major foothold in baby products. The Amazon Elements brands is already strong in Baby Wipes but the company has been testing products in several other subcategories such as Diaper Pail Refills (September 2017) and Pouch Baby Food (December 2017). After a past failure in this category, Amazon has already collected a lot of data on Diapers and has shown their commitment to competing in this space with a month-long 20% promotion in February.

The sample product line, available in 2 styles and several standard sizes, launched in November 2017. Though the February promotion was successful, lifting estimated weekly sales from $20K to $100K, the long-term lift is still uncertain. However, Diapers are a huge category ($530M in 2017 sales), so we expect Amazon to double down in this space sometime within the next 12 months.

AmazonBasics Patio Heaters

Expansion expected: Fall 2018

At the moment, Amazon lacks a strong Lawn & Garden foothold in their Private Brands lineup. In 2014 they release a small set of products under the AmazonBasics brand, with steady sales of about $3M per year and a gradual growth of 10% YoY. Of these sample products, the strongest is an outdoor stand heater available in three styles. In an effort to expand into Lawn & Garden, we are expecting Amazon to introduce a new line of Patio Heaters this coming fall to capture seasonal purchases. The expansion will likely introduce new styles to the AmazonBasics line such as tabletop heaters and wall hangers.

Wild-Card: Basic Care Over-the-Counter Medicine

Expansion expected: 2019 or later

Amazon's latest investment is the August 2017 launch of Basic Care, an over-the-counter medicine brand created in partnership with Perrigo. As the company's first move in the medication sector, it's hard to predict how Amazon will stack up to the competition.

Basic Care launched with 60 individual SKUs, a larger count than almost all of Amazon’s past sample product lines. In Q1 2018, the brand sold only $20K in estimated revenue and has not yet been supported by a kick-start promotion – though that is likely to come in the near future. At this point, Amazon’s Basic Care brand launch is not a bid to take over the online OTC industry; it’s just a first step to determining how and when to make their next move.

It's clear that private brand expansion is a major priority for Amazon – dozens of new sample products are being introduced every year to help the company determine their next big expansion – but Amazon is also constantly tweaking their strategy. So while we've identified the three most likely candidates for expansion in 2018, Amazon has its eye on many more categories as well and will invest wherever there is high demand. At the end of the day, it's consumers that decide where growth takes place; Amazon is just meeting the demand.

One Click Retail is the industry’s most accurate source of sales data for the world’s top eCommerce marketplaces. Using a combination of website indexing, machine learning and proprietary software, OCR estimates weekly online sales figures with market leading accuracy in order to deliver the best insights, analytics and strategies to their brand manufacturer clients. To catch a glimpse of how OCR gives brands critical edge on online platforms with our unique data and expertise, subscribe to our weekly eCommerce insights blog, and follow us on Twitter and LinkedIn.

If you are a brand manufacturer who would like to learn more about how you stack up to the competition—or would like to see your market share and category growth insights—email us at info@oneclickretail.com for a free capabilities demo.