As part of daily monitoring of online stores around the world, Clavis Insight observed that Amazon added the AmazonFresh portfolio to Amazon.com in Southern California, last week.

Before the change AmazonFresh was available only to Prime Fresh members in eligible zip codes, with items hosted on a distinct AmazonFresh website.

Amazon rocked the UK supermarket world earlier this week by announcing a deal with Morrisons, to provide fresh and frozen food products to Amazon’s Prime Now and Pantry subscribers the UK. Now it appears the eCommerce behemoth is quietly preparing to make a major transformation to how it sells groceries in the US.

What happened?

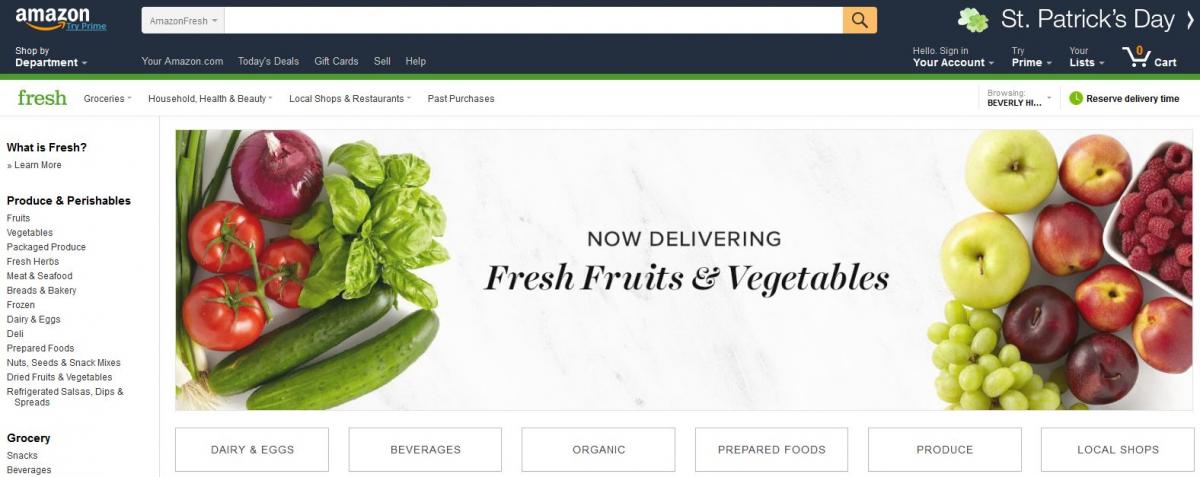

Late last week, in an unannounced move, Amazon added AmazonFresh, previously accessible through a standalone website, to Amazon.com in the Southern California region.

AmazonFresh integrated into Amazon.com in Southern California in February

What does it mean?

Hold on to your hats folks. AmazonFresh is Amazon’s play for the grocery market, a service that delivers fresh and frozen food and beverage items. Integrating it further into the Amazon.com site has significant implications for consumers and suppliers alike.

Amazon has notoriously struggled with its subscription pricing model for AmazonFresh, finally settling on a $299 annual membership cost back in October, 2015. Many shoppers balked at the cost, limiting the appeal and reach of the online grocery service. But if AmazonFresh is integrated into the ever-popular Amazon.com site, alongside Amazon Classic and Amazon Prime Pantry, many more consumers will be able to see what AmazonFresh has to offer as they navigate the Amazon.com site.

Shoppers in Southern California browsing Amazon.com now see that they can add milk, ice cream, meat and fresh vegetables to their Amazon shopping basket. There is still the additional cost of $5.75 per week, but Clavis Insight believes that Amazon is likely to attract new customers to its grocery service in this new integrated "online-store layout."

Amazon has traditionally held its AmazonFresh sales figures near and dear. Unlike with other Amazon platforms such as Prime, AmazonFresh sales data have not been available to consumer goods brands as part of its Vendor Central offering. However, with AmazonFresh fully integrated within the rest of Amazon.com, will this mean that suppliers can finally gain access to more data about their grocery product sales on the eCommerce platform?

Where from here?

For now, Amazon has dipped its toe into the new format by integrating AmazonFresh into Amazon.com in Southern California – yet another reason that 90210 should be your zip code. However, we expect that over the coming months the same approach will be taken in all markets where the online grocery service is currently available. Today this includes areas such as Philadelphia, Seattle and New York City, but the changes could see AmazonFresh becoming a greater force on a national basis in the not too distant future.

The integration into Amazon.com isn’t complete yet, but we expect it will be soon. Currently, if a shopper searches for “organic banana” in All Departments, only shelf-stable, non-AmazonFresh items appear, such as children’s banana squeeze pouches and organic banana chips. The recent changes mean that over time more fresh and frozen items will also appear in Amazon search results, enticing shoppers who see these items to sign up for AmazonFresh Membership to do all of their shopping in one place.

What do consumer goods brands need to think about?

This integration has a number of key implications for brands already challenged to track and monitor how their products are performing on Amazon and other online retailers. Brands across all integrated Amazon platforms will now be competing with each other with respect to search results. For example, shelf stable juice brands available at Amazon.com will now compete with refrigerated juices from AmazonFresh for key search terms such as “juice”. Brands will also need to understand where their product prices sit in the new, combined Amazon portfolio.

Most AmazonFresh products have very few ratings and reviews, and in many cases none at all. Brands will need to prioritize increasing the number of ratings to at least 20, the minimum number of ratings needed to be considered credible by consumers. Additionally, product page content for AmazonFresh items is often underwhelming compared to typical Amazon product pages, which often contain multiple images, video and extensive product descriptions. Finally, all brands across Amazon platforms will need to monitor availability closely as the integration could produce unforeseen spikes or drops in product sales.

Amazon continues to extend its dominance in the online channel, including making decisive moves into the US and UK grocery markets. Consumer goods manufacturers and brands need optimize their online presence and performance across Amazon platforms and all key online retailers to capture this growing opportunity.

To learn how to win on Amazon, click here to watch the on-demand version of our popular webinar "Pasta on Prime! Barilla’s Amazon Success Story".