2018 was another landmark year for Amazon. In what has become an annual tradition, the retail and tech juggernaut set new one-day sales records on both Prime Day (July 16) and Cyber Monday (November 26). In Q3, Amazon's quarterly profits broke $2 billion for the first time, aided by its lucrative cloud services division, AWS, recent acquisitions including Whole Foods and PillPack and the growing market share and broadening assortment of private labels and Amazon-exclusive brands.

Today, Amazon is much more than a retailer. AWS, Amazon Publishing and Amazon Studios are all huge organizations in their own right and technologies like Alexa are spreading well beyond their initial applications. But the face of this expanding tech ecosystem remains Amazon.com, the marketplace that started it all – and a key driver of that marketplace is consumables.

Amazon's biggest product group by sales is consumer electronics. With the Echo line of smart speakers consistently topping sales charts and other Alexa-powered home automation devices frequently making the news, this category seems to get all the attention. But consumables is a close second and is arguably even more important. Consumer electronics tend to be high-cost, one-time luxury purchases, while consumables tend to be low-cost, high-volume household necessities. This makes consumables are critical category for driving traffic. Low-cost household commodities are what keeps customer coming through the proverbial door week after week. Because shoppers come back more often for their daily staples, they spend more time on Amazon.com overall and are in turn exposed to more products.

A few weeks ago, the Wall Street Journal reported that Amazon is cracking down on items designated as CRaP. Amazon has been using this designation for years to identify products that have such slim (or non-existent) margins that the retailer 'Can't Realize a Profit.' While the risk of 'CRaPing out' is old news to any brand selling on Amazon, this story has inspired some commentators to argue that other platforms like Boxed have an opportunity to step in and capture the low-priced, low-margin commodity market – but we don't see this happening. Amazon has earned the 'everything store' badge by training consumers to embrace its one stop shop nature, to the point that Amazon.com is now even more popular than Google as a product search engine. So if low-cost consumable brands abandon Amazon for fear of CRaPing out, they will also close themselves off from half of all online shopping in the US.

To help illustrate the value of Amazon to consumables brands we have tracked the growth of three key product groups in 2018: Grocery, Health & Personal Care and Pet Products. We would like to share some of our high level findings and our insights into how the retailer's ongoing plans in this space will develop in 2019 and beyond.

Health & Personal Care is Amazon's largest consumables product group and one of the retailer's largest groups overall. In 2018, the group accounted for an estimated $5 billion in sales, a growth of 35% YoY. A cornerstone of this group is paper products, which fall under Household Consumables. Amazon's penetration of paper products is very high and remains stable, with category growth steady at 25%, bringing est. total sales to $500 million. The recurring nature of paper product sales provides Amazon's HPC group with a reliable flow of traffic.

The bulk of growth in HPC was driven by mineral supplements, which nearly doubled in sales compared to 2017, and most of the credit can go to third party sellers (3Ps). In the broader Vitamins, Minerals and Supplements (VMS) subcategory, which grew by 65% last year, 3Ps now command over 50% of the market. Garden of Life and NOW, both first parties, remain the largest VMS brands overall, but experienced a 20% loss of market share to 3Ps, with share losses led by Sports Research and Bioschwartz.

Health Care similarly grew by 50% with pain relief, allergy and cold symptom relievers all nearly doubling in 2018. Growth in both OTC medications and VMS are illustrative of the consumer trust Amazon has earned.

Health and wellness is one of the last sectors to move online as the public continues to grow more comfortable with ecommerce – and Amazon, which is largely responsible for that comfort, is well aware of the opportunity this poses. In mid-2018, Amazon acquired PillPack, a full-service online pharmacy, which solves one of the retailer's key barriers in this space: the challenge of acquiring pharmaceutical licenses to sell online in all 50 states. Given that PillPack can also include VMS and other OTC pills in their service, it's very likely that the retailer is exploring ways to cross sell non-pharmaceutical, health related products from its .com marketplace to PillPack users, while at the same time marketing the PillPack service to Amazon.com’s 300 million account holders.

Amazon's ambitions don't stop there. One of the biggest ongoing stories to come out of 2018 is the health care venture jointly launched by Amazon, Berkshire Hathaway and JPMorgan Chase & Co. The purpose of this venture is ostensibly to provide affordable health insurance to US employees of each of these companies, but it's not such a stretch to expect this 'Prime Health' service to be made available to the general public in due time. These ventures, as well as the retailer's recent introduction of private label OTC and VMS brands, point to an imminent disruption of the health care space by Amazon.

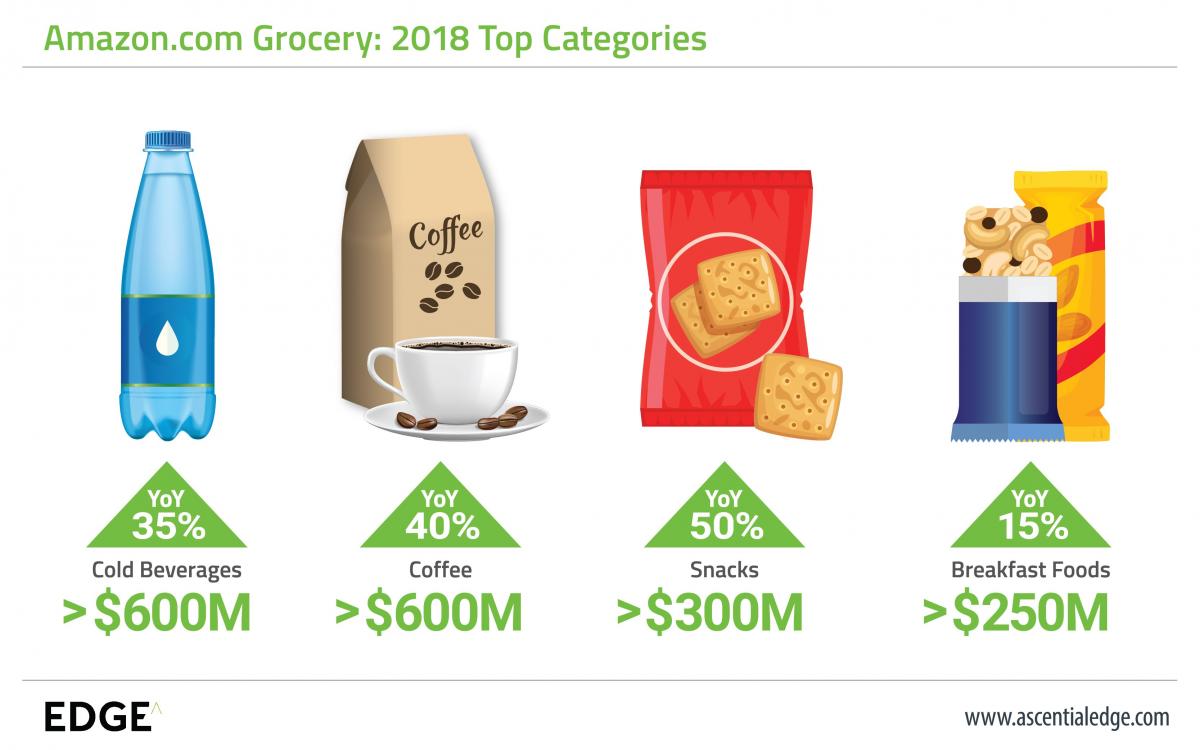

Grocery in 2018 saw US a shift toward healthier alternative in both beverages and snacks, and Amazon's product group has been a microcosm of these evolving tastes and preferences. The US soft drink market is down for the 13th consecutive year and Amazon's negligible growth (<5%) in that subcategory is only a result of more consumers choosing Amazon over other retailers. By comparison, energy drinks and ready-to-drink (RTD) juice both grew by 50% in 2018, with much of that growth driven by people quitting soft drinks.

Coffee continues to rank head and shoulders above any other grocery product type on Amazon, earning as much in sales as all Cold Beverages combined and growing at 40% YoY. Single-serve coffee pods hold a market share of over 80%, while the small RTD coffee subcategory doubled in size. Like in the VMS category, 3Ps are also making a bid for the American breakfast – both the Coffee and Breakfast Food categories saw 3Ps ranking among the bestselling items of 2018.

Snacks generated the most growth in 2018 and again this can be largely attributed to healthier subcategories such as snack corns, seeds and nuts which grew by over 90% YoY and seaweed snacks, light snacks and dried fruit which grew by over 60%. In turn, the market share of traditional snacks such as salty snacks and dried meat fell by 15%.

Despite these strong categories, Amazon's Grocery sales still leave a lot to be desired. The YoY growth rate fell by 25% compared to 2017 and perishables still make up an extremely small portion of those sales. After spending years investing in sub-par programs like Amazon Fresh and Prime Pantry, consumers still aren’t sold on buying fresh food online. This was certainly a major factor in the 2017 acquisition of Whole Foods. The recent announcement that Amazon plans to add more Whole Foods stores across the US, including many in suburban areas, shows that the retailer is finally shifting its focus from online grocery sales in favor of increasing its physical footprint.

For grocery brands, this means location based analytics will become a crucial tool in an effective Amazon/Whole Foods strategy. Out of stocks are one of the biggest issues for grocery brands on both the physical and digital shelves. To prevent customers from substituting their preferred brand for a competitor or store brand, suppliers will need hyper local analytics capable of monitoring regional pricing and accurately forecasting inventory needs.

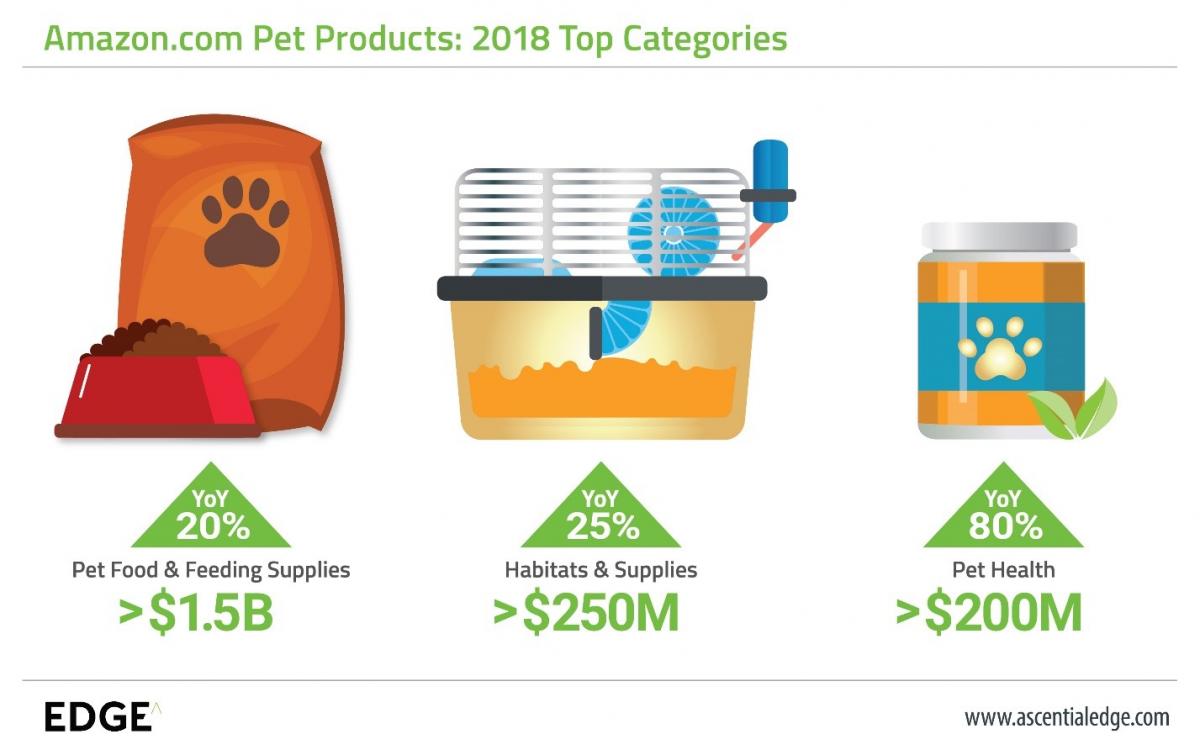

As the second-largest consumer packaged goods market in the US (after health supplements), it's no surprise that Amazon has made Pet Products a priority in recent years with private brand expansions and initiatives such as Alexa Pet Week. The pet population in the US is at an all-time high and the retailer's sales reflect that, with Pet Food maintaining a stable 20% YoY growth rate and a remarkable 80% growth rate in the Pet Health category. However, Amazon is not the industry's biggest online player: that honor goes to Chewy.com.

Amazon's role as a retail generalist is one of its advantages, attracting a steady stream of repeat customers which value its one stop shop nature. But in certain contexts, this quality can become a significant disadvantage. Chewy, which was purchased by PetSmart in 2017 (in what was the largest ecommerce acquisition at that time), is an ecommerce specialist with a focus on phone and email support, offering pet owners the peace of mind that can only come from a specialized professional. In recent years, the humanization of pets means that Amazon's generalist nature makes the retail giant less attractive to animal lovers.

One of Amazon's solutions to this problem is the introduction of private brands. The retailer already tops the Habitats category with AmazonBasics Pet Training and Puppy Pads, the #1 item of 2018. Amazon also released two distinct dog food brands last year, one with the unique label Wag and another under the broader household consumables brand Solimo.

This strategy extends to HPC and Grocery as well. Health & Personal Care features a wide range of private labels and exclusive brands, including but not limited to Basic Care OTC medication, Mama Bear baby diapers, Revly supplements, OWN PWR sports nutrition, Presto! paper products and a broad assortment under the Solimo banner. Solimo also has a presence in the Grocery category in the form of coffee pods, along with Wickedly Prime, Happy Belly and the Whole Foods house brand 365 Everyday Value. However, both of these categories suffer from the same challenges as pet food.

Amazon has cultivated a remarkable amount of consumer trust, but it will always be at some disadvantage to the personal touch of a local grocer, pharmacist or veterinarian. Amazon.com is still drawing more customers every year, but a subset of consumers is moving in the opposite direction in favor of hyper-local independent producers. The 'everything store' will never be the 'everyone store' – but it's committed to getting as close as possible. How close will that be? We'll have to keep watching in 2019 and beyond to find out.