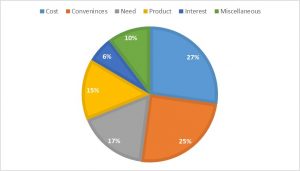

In a result that might surprise some, cost only slightly beat out convenience as a driver of ecommerce. With 1 in 4 shoppers looking to take advantage of free shipping, same day delivery, and/or click and collect, it is important for retailers to expand their shipping options to meet the growing shopper expectation for convenience. Retailers and brands that best fulfill this need will continue to build customer loyalty in the future.

Of the major ecommerce retailers we tracked, FreshDirect, Amazon Fresh, and Instacart are delivery-only; click and collect is not an option for these ecommerce-first retailers. However, FreshDirect does allow shoppers to pick up items at their facility in Long Island City (east of Manhattan), convenient only if shoppers live very close by.

Clavis Insight Survey: 1 in 4 Shoppers Said That Convenience Was The Most Important Factor When Shopping Online

Benefits and Challenges for Click and Collect vs. Home Delivery

But why would a shopper choose click and collect over home delivery or traditional in-store options? For starters, if an item is needed right away, such as fresh groceries, then click and collect emerges as a powerful time-saving tool. Shoppers get to skip the lines and avoid busy aisles, and instead simply schedule pick up at a convenient time. For brands and retailers, there is an even bigger benefit: many services such as Amazon and PeaPod highlight previously bought items. If a shopper grows accustomed to always ordering one set of canned fruit from Peapod, then they can have that item automatically added to their cart next time they shop. Here we see click and collect checking multiple boxes, meeting shoppers’ needs for convenience and brand’s desires to reduce the turnover of shoppers browsing around for a competitor's product.

Amazon started its Locker program many years ago to tap into this click and collect market. However, there is no alternative service in place for Amazon Fresh. Here we see a market where Amazon may not have a leg up, as PeaPod (Stop & Shop) and Walmart Grocery can turn their psychical stores into distribution as well as pick-up centers.

However, this furthermore creates two problems for shoppers. One is that Shop & Stop is not a national chain, so PeaPod service is only available in the northeastern US. It is possible that if shoppers continue to pressure retailers to offer click and collect services, then more supermarket chains will be able to take advantage of this demand. This will lead to an increasing fragmented market in the grocery space.

Home delivery offers some clear advantages: the ease of not transporting items yourself being chief among them. Shoppers that are not in a rush to get the item can sit back and wait for it to show up at their front door. City dwellers without a car can order heavy to carry items such as a large TV with ease, assuming their is a safe spot to leave the item if they are not home to collect it.

The downside to both click and collect and home delivery is that "impulse" buys (and subsequently smaller basket sizes) may be less likely to occur if shoppers are not browsing in-store. Finding ways to increase basket size online (highlighting past items, discounting larger baskets ala Jet) to help keep those sales strong.

Alternative Fulfillment Methods Increase Pressure on Product Availability

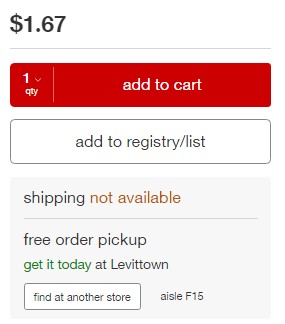

Although click and collect and home delivery are convenient for shoppers, they increase supply chain complexity and put pressure on product availability. For example, surfacing accurate in-store availability online is still not widely offered. PeaPod and Instacart allow shoppers to pre-select a substitute item, but this is the opposite of convenience. To help satisfy the 1 in 4 shoppers that said convenience is more important to them than price, grocery (and other markets) are going to need to surface in-store availability information online. No retailer is currently offering this in the grocery space. However, other retailers have been adding this feature for non-grocery items. Target has greatly expanded its click and collect infrastructure, and now offers the exact in-store location of the item along with its availability.

Going Forward

As more consumers move online, demands for more flexible purchase and fulfillment options will continue to increase. Some retailers are pulling ahead, doubling down and offering comprehensive availability information on their websites. Others, mostly in the grocery space, are starting to lag behind. There could be a few driving reasons for this, one being that online grocery is a newer online category with much lower penetration than other categories. Another is that fresh grocery items have higher inventory turnover, and thus make it harder to predict or bar-code individual items of fruit. However, increased popularity with customers means that a greater percentage of sales will flow through the ecommerce channel. We expect retailers to keep up with that demand in order to stay relevant and protect (or perhaps expand) their market share. Brands that successfully scale their operations and fulfillment offerings set themselves for success in an ever-increasing omnichannel retail environment.