Health & Beauty shoppers are demanding, inconsistent, eco-conscious and omnichannel. Has your brand sufficiently adapted to meet your customer’s high expectations?

CES, the most influential event in technology, is set to return to Las Vegas in January albeit in the shadow of the COVID-19 pandemic, which is still very much a cause for concern. The annual event has been connecting technology leaders, policymakers, retailers and buyers since 1967 and more than five decades later, in 2022, you can expect the innovations that will be unveiled will be as groundbreaking- or more so - than in the past.

The COVID-19 crisis changed daily life for all almost overnight and pushed almost all industries to experiment and innovate with technology innovations just to stay in business. Now, almost two years later, expectations of education, work, government, health, entertainment and shopping have changed for good and most industries have evolved to be much more digitally sophisticated than they would have otherwise been.

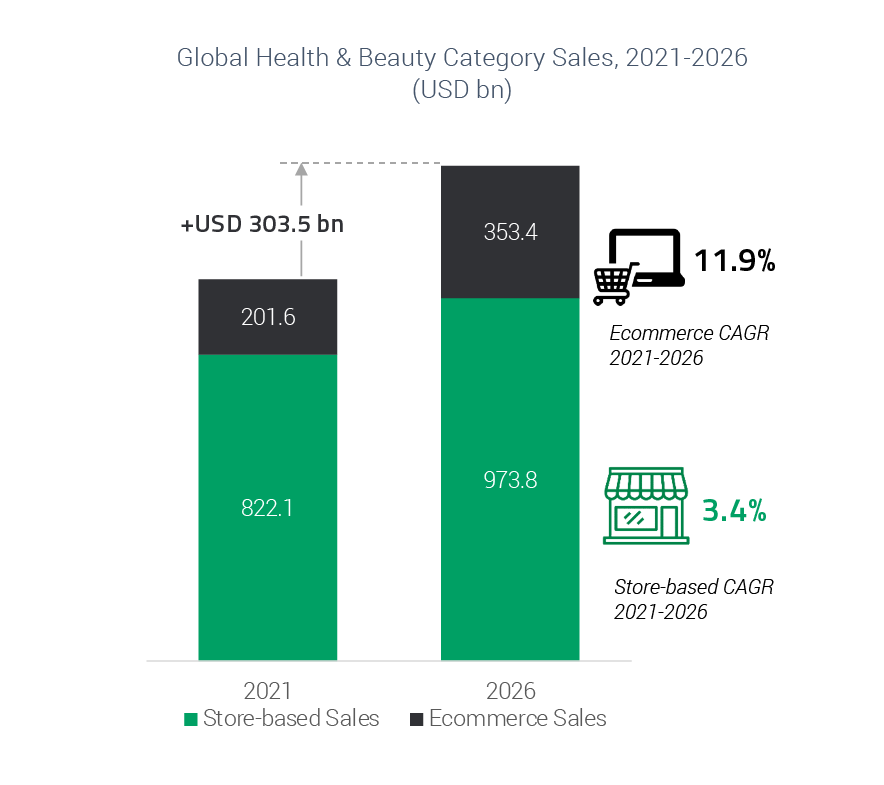

Glow up: Health & Beauty ecommerce to grow more than 50% between 2021-2026

Pre-COVID 19, the Health & Beauty category was slow to embrace the online environment. Shoppers in this space tend to want an immersive and personalized shopping experience, wanting to “try before they buy”. Expert advice has also typically played a big role in the path to purchase, particularly for skincare, cosmetics, fragrance and health-related products. But most stores were shut during the lockdowns of 2020 and into 2021 and with people nervous to venture out into high streets, forward-thinking Health & Beauty retailers and brands made bold moves to connect and engage with their customers at home.

Adopting augmented reality technology to replicate the experiential aspects of makeup and hair colour application and social media as an additional sales channel are some of the ways manufacturers have been evolving to stay relevant, acquire customers and boost sales. Retailers, meanwhile, have launched shop-in-shops, strengthened digital shopping experiences and added vital health services to their portfolio of retail offerings as competition in the category heats up.

Brands have launched and scaled Direct-to-Consumer (D2C) offerings at pace, while a number of savvy Health & Beauty entrepreneurs have launched ecommerce-first businesses to take advantage of the dramatic shift to online orders as well as demand for better-quality, alternative and sustainable curations. Meanwhile, major retailers and investment firms have made significant acquisitions to reflect where they believe the growth will come from over the next few years. Examples include THG - formerly The Hut Group - buying online premium retailer Cult Beauty in a £275 million deal and US investment firm Carlyle’s US $1 billion purchase of “clean” beauty brand Beautycounter.

The blockbuster stock market listing of Indian cosmetics and wellness ecommerce business Nykaa in November 2021 underlines investor confidence in global online Health & Beauty growth - as well as the scale of the opportunity for suppliers that embrace the changing shopper environment, fragmented online-to-offline path to purchase and get really close to their customer’s shifting priorities in 2022 and beyond.

Our latest Health, Beauty and Personal Care report (October 2021) forecasts that more than 50% of sales in the sector will come from ecommerce between 2021 and 2026 as the category in total adds more than US $300 billion by 2026.

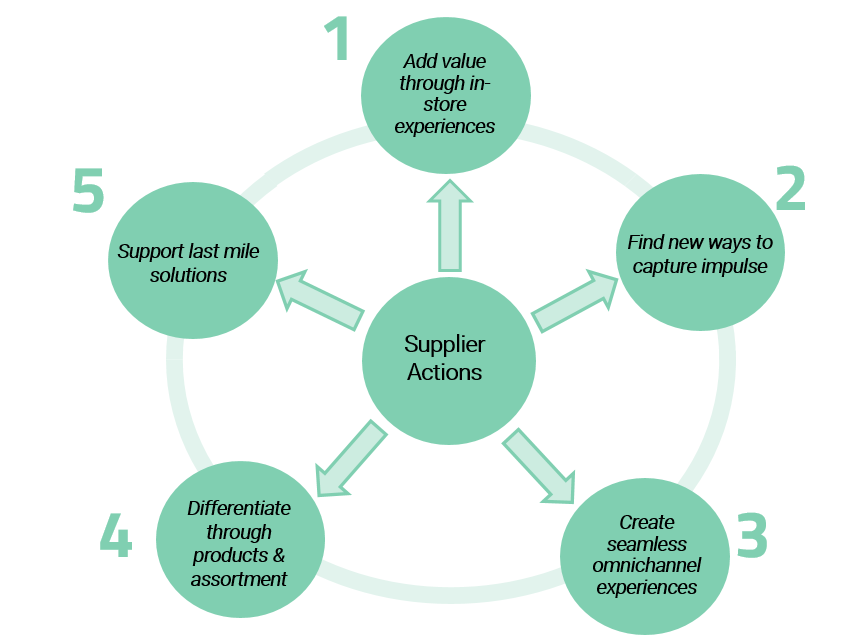

See below for how some of the operators in the category have been responding to take advantage of the new era of omnichannel shopping in Health & Beauty.

Case study

SEPHORiA: Virtual House of Beauty

The basics: LVMH-owned Sephora in 2021 launched a digital version of its annual shopping event – ‘House of Beauty.’ It previously held physical events in 2018 and 2019, pre-pandemic. The event featured 3D games and an interactive beauty house, with various ‘rooms’ to explore.

Attendees of the event obtained access to live and pre-recorded content from beauty brands, beauty icons and surprise guests.

Why does this matter? In the wake of elevated consumer digital adoption and an uncertain backdrop caused by a fickle virus, retailers are investing in digital touchpoints and experiences, digitizing in-store events and adopting live streaming for product demonstrations.

Supplier watch-out: The rise of virtual events gives suppliers a new avenue to provide product inspiration and experimentation. Beauty brands should engage closely with retailers on these events, supporting the development of virtual experiences, such as online games or live product demonstrations with experts to drive visibility for their brands.

Case study

Verishop launches curated Snapchat store ‘Verishop Mini’

The basics: Verishop in the US has launched ‘Verishop Mini,’ a curated shopping experience available exclusively through the Snapchat app. The curated store, accessible through Snap’s rocket icon within chat and search, features beauty brands including Kosas, R+Co, Blume, EXA, and Saie. It also features fashion brands.

Why does this matter? Retailers are increasingly investigating the potential of social commerce, trialling partnerships with platforms to drive additional opportunities for positive connections with consumers.

Supplier watch-out: Brands should drive their presence and capabilities on burgeoning new social platforms, using digital touchpoints such as livestreams and content created by key opinion leaders to influence product awareness and offer inspiration.

Brands must evaluate the features and client base of different social shopping platforms to identify the right partner for the brand.

Will you be at CES? To hear more about how Health & Beauty suppliers can optimize the new era of tech-centric retail where online and offline channels are blurred and customer demands fluctuate faster than ever before, book a meeting with Xian Wang, VP, Edge Retail Insight, Edge by Ascential.