As revealed by Edge by Ascential Future Retail Disruption 2021-2022 Report

- Ecommerce will account for 32% of UK chain retail sales in 2021, up from 29% in 2020

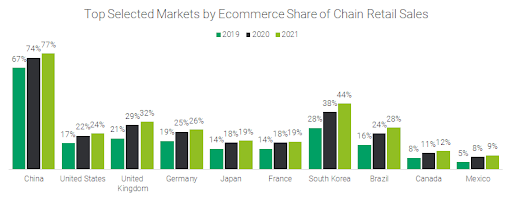

- Ecommerce share of chain retail will also grow in every major market in 2021 even after the bumper year for online sales in pandemic-hit 2020

- Physical store growth worldwide between 2021 and 2026 will be static or in decline

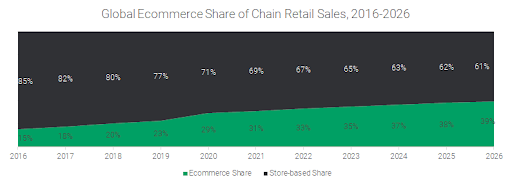

London - 26, November 2021- Edge by Ascential, whose technology-driven products power brands to win in digital commerce, has released its annual Future Retail Disruption Report for 2021-2022. The data shows that shoppers will continue to buy online post-pandemic, and to a greater extent than pre-COVID -- predicting that online sales will account for almost 40% of global chain retail sales by 2026.

Ecommerce growth accelerated during 2020 as the pandemic forced shop closures and there was an epic shift to online buying. Edge Retail Insight, Edge by Ascential’s industry-leading data forecasting and retail research portal showed the pace of growth of online shopping in 2020 was twice as fast in most major markets than had been previously forecast, rising 37.4% worldwide. In 2019, ecommerce globally grew by 18%.

In the UK in 2019, ecommerce share of chain retail sales stood at about a fifth (21%). By the end of 2020, this had grown to 29% and in 2021 it is 32%. Over the next five years, Edge Retail Insight anticipates that ecommerce will account for two thirds of Britain’s chain retail sales growth (66%) and by 2026 online shopping will account for 38% of the country’s chain retail sales - almost equivalent to the global figure.

Edge Retail Insight’s Future Retail Disruption Report for 2021-2022 shows the lasting impact of the COVID-19 crisis on retail. It shows the biggest drivers of consumer behaviour going into the new year, and how retailers and brands can plan and innovate for this new operational paradigm shift.

Source: Edge Retail Insight, data sourced September 3, 2021 (variations may occur after this point)

Xian Wang, VP, Edge Retail Insight, said: “Every six months or so we revisit our set of STEIP (Society; Economy; Policy, Technology and Industry) drivers of change to assess the implications for the retail landscape over the next one, three and five years. This is so we can remain trusted advisers to the consumer brands we serve to help them understand how their operations must evolve to stay relevant and thrive in fast-moving times.

“COVID-19 accelerated many changes that were already taking place and in this report, we have focused on recent developments in last-mile fulfilment, , the growth of retailer media and the transformation of retailers into digital ecosystem platforms powered by data and analytics. In addition, we review the state of physical store networks as the shift to online sales puts pressure on the high street. These are some of the biggest areas of change in the retail landscape as we look to 2022.

“Retailers are innovating and investing to offer a better fulfilment experience to their customers and the last mile has become a key battleground to lock in shopper loyalty. UK retailers have been trialling speedy delivery initiatives (Tesco ) and partnering with delivery intermediaries (Morrisons) to raise their game and compete with the likes of Amazon, which seems keen to become a serious rival in UK grocery in 2022.

“Globally, of the almost 2,500 retailers we cover at Edge Retail Insight, two-thirds (60%) now offer two-hour delivery (or faster) and almost 30% commit to deliver in 30 minutes, as ultra-rapid VC-funded startups push the envelope with regards to customer expectations. “

Source: Edge Retail Insight, data sourced September 3, 2021 (variations may occur after this point)

The report focuses on these drivers of change:

- Omnichannel fulfilment diversity: The past year has rapidly increased table stakes for last-mile fulfilment through both owned and partnered pickup and delivery. Same-day options are now the norm across advanced ecommerce markets, with rapid delivery players offering delivery in 30 minutes or less in many cities.

- The rise of retailer media platforms: As traditional retailers look to offset the cost of last-mile fulfilment, many of the bigger names are morphing into sophisticated advertising players through ad-tech partnerships or developing their own capabilities to monetise web traffic. Edge by Ascential’s sister brand, WARC, forecasts that retailer media will grow three times faster than the all-media rate in 2021.

- Declining store real estate: The dramatic shift online will accelerate physical store closures. Across channels, compound annual growth rate (CAGR) will either remain static or shrink over the next five years.

Wang added: “In 2022, the brands who can master digital retail platforms and the new operating environment will put themselves in the best situation and will be ahead of the game to succeed in the future of retail”

About the report

Data and insight comes from Edge by Ascential’s Future Retail Disruption Midyear Update, September 2021-2022, available on subscription to the Edge by Ascential Retail Insight platform. The report was created with data from Edge by Ascential’s proprietary analytics tool, Retail Market Monitor, which can analyze the entire retail ecosystem by sector, geography and channel, and identifies growth opportunities for retailers and brands.

Retail sales referenced are calculated using Gross Merchandise Value (GMV), a standard used to measure the size of a third-party (3P) marketplace. It is calculated by multiplying the number of products sold by the price at which each product was sold over a given time period. Retail sales data includes online and offline operations, and only includes chain retailers, of which Edge Retail Insight covers almost 2,500 worldwide.

Our forecasts change week-by-week because of the fast-changing developments in the market; today as a result of the pandemic and evolving government messaging around lockdowns, but also because of the fast-paced changes and developments in digital innovation and e-commerce.

About Edge by Ascential:

Edge by Ascential powers the digital commerce segment for brands. The world's leading brands focus their local and global go-to-market strategy by using Edge’s predictive retail intelligence technology, advisory services, digital shelf monitoring insights and market share performance analytics. We're giving global brands the strategy, execution and performance edge they need to win in digital commerce.

About Ascential:

Ascential delivers specialist information, analytics and eCommerce optimisation platforms to the world's leading consumer brands and their ecosystems. Our world-class businesses improve performance and solve problems for our customers by delivering immediately actionable information combined with visionary longer-term thinking across Digital Commerce, Product Design and Marketing. We also serve customers across Retail & Financial Services.

With more than 2,000 employees across five continents, we combine local expertise with a global footprint for clients in over 120 countries. Ascential is listed on the London Stock Exchange.

For more information, visit www.ascentialedge.com.

Media enquiries

For further information, please contact:

Will Parrott/Emma Cheshire, Propeller PR

Edge@propellergroup.com