According to Bazaarvoice, 61 percent of consumers consult reviews and star ratings before making a purchasing decision. And that’s whether or not they buy online or in-store. With online reviews increasingly serving as a brand’s front door, eCommerce managers are taking notice.

These ratings and reviews are so compelling because 88% of consumers trust online reviews just as much as a recommendation from a friend. Because of the trust consumers place in reviews, closely managing this aspect of the online retail store experience has become critical to both product and brand success.

But how can brands make the most of this user generated content to increase online and offline sales, or aid new product introductions? In this three part series we explain the key steps manufacturers need to take to organize their ratings and reviews, engage shoppers, and listen and respond to buyer feedback. The series is designed to help brands maximize the impact of this content treasure-trove in online stores. Part one is about organizing for success.

To learn how consumer goods giant Unilever uses Clavis Insight’s Shopper Review Diagnostics to monitor the impact of review content, enabling it to organize, listen to and engage with online store ratings and reviews, sign-up for this March 30th Webinar.

Part 1: Get Your Ducks in a Row and Organize

The first step to optimizing and utilizing your consumer feedback at online retailers is to organize your trove of product ratings and reviews across retailers. Even brands with small portfolios can find themselves with hundreds and even thousands of reviews and few resources to manage them.

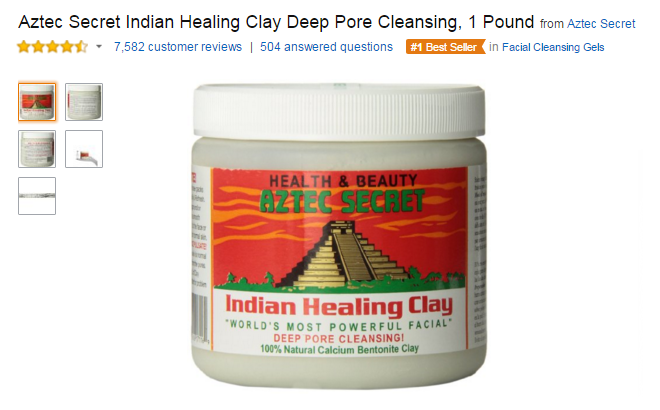

In our first example below Aztec Secret only has one product available at Amazon.com, but this small company has over seventy-five hundred reviews to manage. While reviews are generally positive, 13 percent are critical – defined by Amazon as ratings less than four-stars – and the supplier hasn’t responded to any of them. This could negatively impact sales and brand perception, and needs to be remedied.

An Aztec Secret product at Amazon.com with thousands of reviews

Brand managers can’t afford to let the sheer volume deter them from diving into their ratings and reviews, but they must bring method to the madness, by first classifying and segmenting them into manageable groups, and then addressing the most critical review-related issues.

- Classify: Classify your ratings and reviews across retailers by star rating, and as organic or syndicated, parent or child, and responded or not responded. Brands can get their rating and review ducks in a row by classifying existing and incoming ratings and reviews into these groupings to prioritize analysis and action.

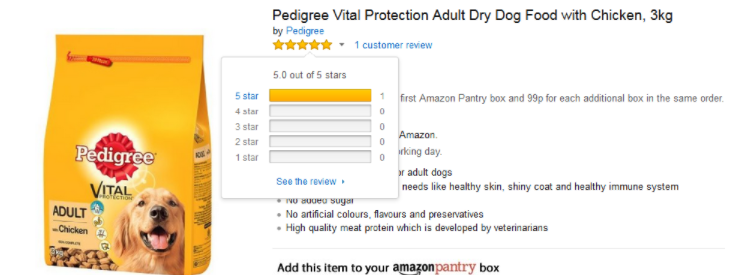

- Segment: Now that your ratings and reviews are sortable by key classifications, segment your products into the groups that need action, such as items with too few reviews and negative reviews than you need to respond to. A Pedigree dog food product at Amazon.co.uk has a perfect average product rating of five-stars. However, this is based on feedback from only one happy customer and may not pass the credibility test for online shoppers.

A Pedigree item at Amazon.co.uk whose five-star Rating is only based on one review

- Identify keywords: Identify keywords to help you to uncover patterns in consumer feedback and expose critical issues. For example, a diaper manufacturer can identify “leak” and “torn” as key words to be monitored to enable the brand to take targeted action. An Earth’s Best diaper product on Amazon.com positions itself as good for the environment and secure enough to prevent leaks. Though the brand has an average rating of 4.1-stars, critical reviews counter its product message “I ended up doing 4Xs as much laundry with all of the leaks. So I not only used a ton more diapers than other brands, but also all of energy and resources used for the laundry. Not too good for this earth.” Such feedback is damaging to the brand and Earth’s Best should flag keywords for follow-up.

Once you’ve organized your existing and incoming ratings and reviews, you’re ready to set goals and take action. Come back next week to understand how engaging your existing buyers to rate and review your items will help you win with new buyers.

Click here to sign up to join Unilever’s Digital and eCommerce Capabilities Manager, Jenna Spivak Evans, along with Clavis Insight’s Danny Silverman on March 30th for a case study on how the consumer goods leader is executing best practices to capture and leverage online store ratings and reviews.